By: Rebekah de la Mora, Policy Analyst

With the passing of the Infrastructure and Investment Jobs Act of 2021, $8 billion dollars worth of focus was placed on the most abundant element in the universe: hydrogen. Specifically, hydrogen used for energy purposes. Some may know a significant amount about hydrogen energy; some may know of it only through the disastrous Hindenburg accident of the 1930s; and some may know nothing at all. Some find it to be a waste of time and resources, some find it to be a key solution in the fight against climate change, and some find it to be a solution like any other. Hydrogen is not as in the public sphere as energy sources like natural gas, wind, or solar, but discussions surrounding it are becoming more and more prevalent.

What is Hydrogen Energy?

While hydrogen is always made of the same component -- H2 molecules -- the ways to get there vary. When talking about said ways, they are categorized by color. The colors refer to the process used to make the hydrogen and the energy source, or "feedstock." Black, brown, and gray hydrogen refer to steam methane reformation or gasification using coal or natural gas/methane; blue hydrogen is the same, but with the addition of carbon capture and storage. Green hydrogen refers to electrolysis using renewably-sourced electricity; pink or purple hydrogen also uses electrolysis but with nuclear-sourced electricity, while yellow hydrogen is specifically solar-sourced electricity only. Turquoise hydrogen refers to methane pyrolysis using natural gas/methane; this method is not yet at-scale. White hydrogen refers to naturally-occurring or fracking-created hydrogen that is "mined" for use; this method is more theoretical and not yet in practice. Policies on decarbonization-via-hydrogen tend to focus on green hydrogen, with blue hydrogen also relatively popular. Many policies may use the phrase "clean hydrogen," which often implies green, pink/purple, yellow, and occasionally blue.

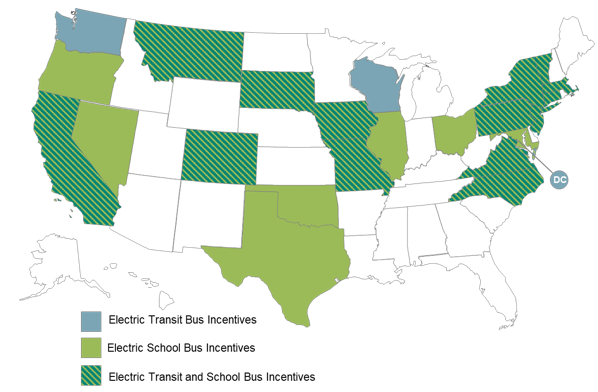

The end-uses of hydrogen vary, and do not depend on the color. Overall, its uses fall into three main categories: replacing carbon-intensive sources of energy, a component in product manufacturing, and energy storage. First, hydrogen can be used as an alternative fuel in transportation; depending on the exact technology, hydrogen-powered vessels like boats or heavy-duty trucks are more feasible than electric versions. Hydrogen can also be used to decarbonize various industrial processes, particularly hard-to-decarbonize sectors like steel. Hydrogen can even be blended with natural gas for heating purposes. Second, hydrogen is a major component in ammonia and fertilizer production for agricultural use. Third, hydrogen can be used as a form of energy storage, "storing" electricity until it is needed, at which point the hydrogen undergoes reverse electrolysis to generate electricity. Hydrogen is often seen as a solution for long-term or long-distance storage; for example, storing solar power from summer to be used in winter, or importing green hydrogen from another country to provide renewable energy.

Hydrogen in State and Federal Policy

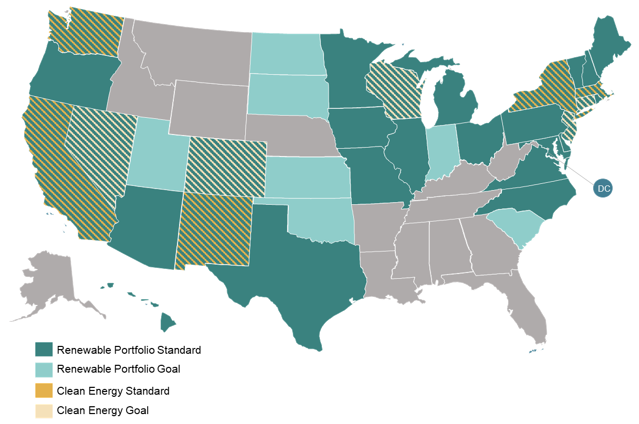

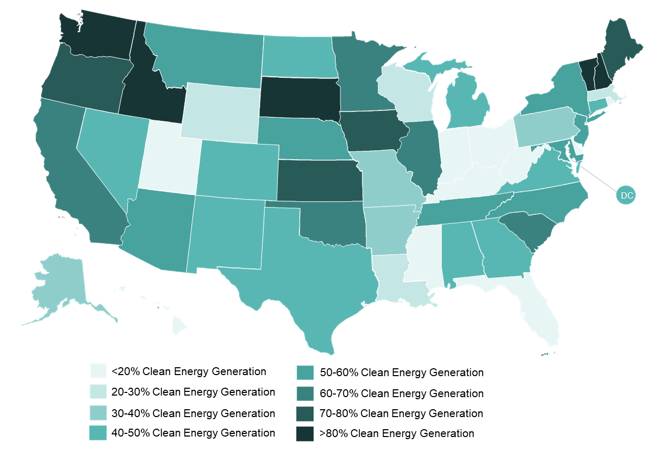

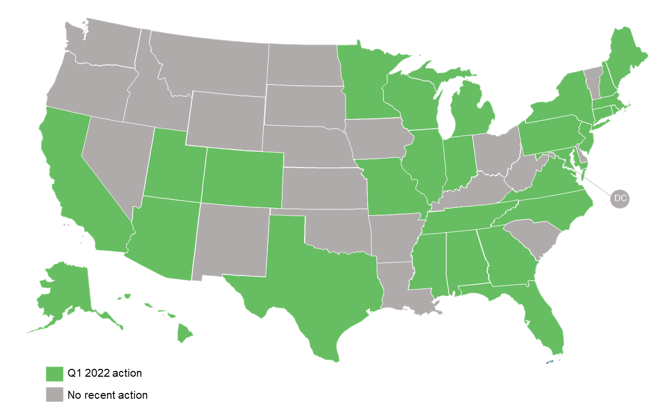

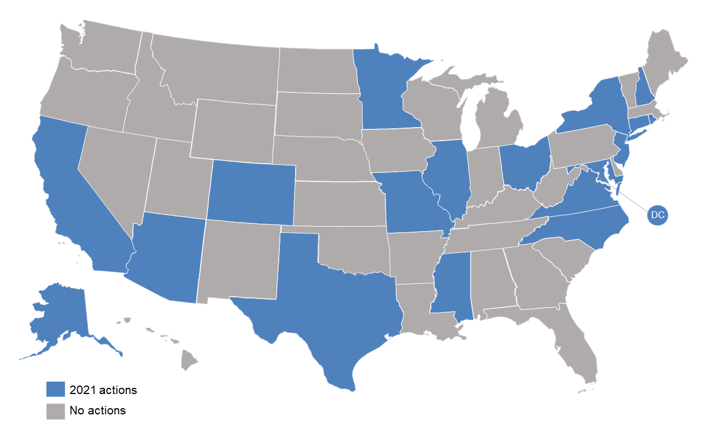

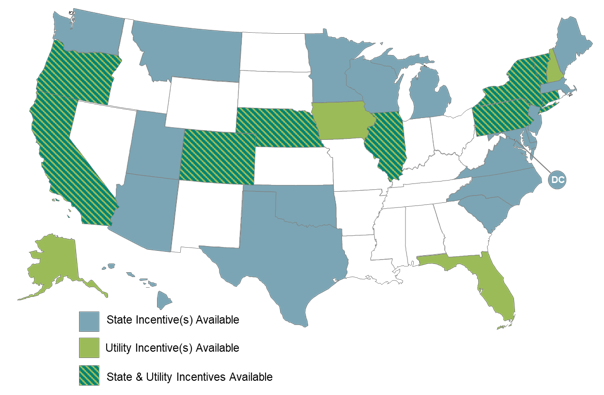

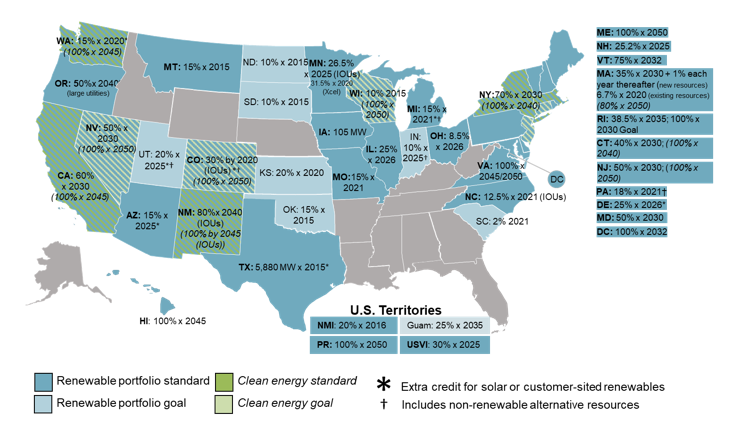

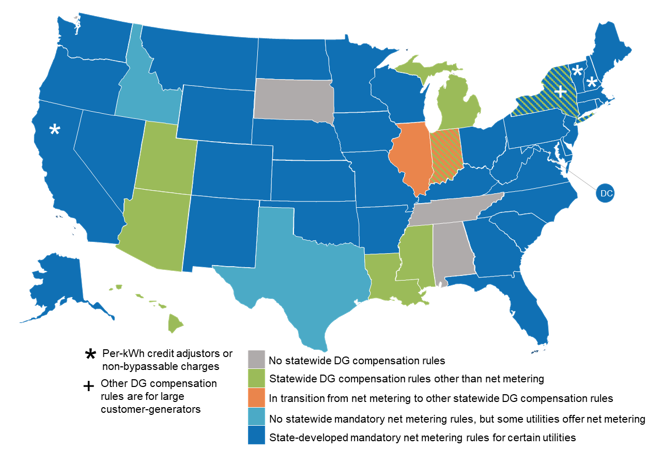

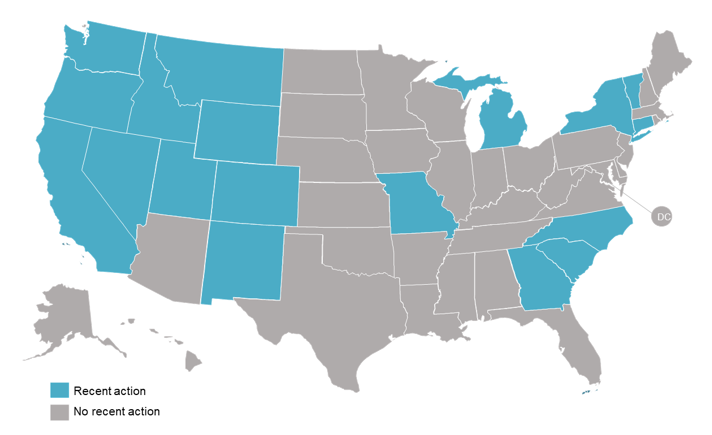

At the subnational level, many states are attempting to include hydrogen in their clean energy policies. One of the easiest actions is including appropriations for hydrogen in state budgets. Hydrogen is often integrated into alternative fuels or electric vehicle programs, from providing incentives for fuel cell cars to encouraging development of heavy-duty hydrogen vehicles. In conjunction with the regional hubs initiative, many states are establishing studies, working groups, or committees to look at hydrogen infrastructure and feasibility. Hydrogen is also being included in policies related to GHG reductions and transportation decarbonization, specifically clean hydrogen; energy targets are also incorporating clean hydrogen or hydrogen from renewable sources as an eligible energy source.

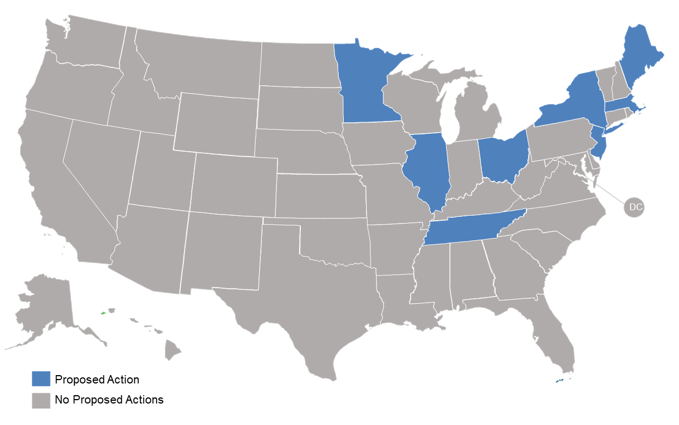

At the national level, the Infrastructure and Investment Jobs Act of 2021 provides $8 million in DOE funding to develop regional hydrogen hubs across the US. The money is expected to fund 4-8 regional hubs. The law requires that the hubs vary their feedstocks, end-uses, and geography to ensure a variety of hydrogen frameworks are put into practice. Many states have begun collaborative efforts to receive the funding, signing agreements or memorandums with neighboring states and organizing groups to respond to DOE's Request for Information on the subject. At least 18 states have officially declared their intentions to pursue the funding, of which there are 4 regional agreements: Arkansas, Louisiana, and Oklahoma; Colorado, New Mexico, Utah, and Wyoming; Connecticut, Massachusetts, New Jersey, and New York; and North Dakota and South Dakota. The other states have declared their intent, but have not signed an agreement with other state governments to pursue a joint regional hub. Some states have expressed interest via stakeholder workshops or private-sector interests, like the Southeast Hydrogen Energy Alliance in the Carolinas, but have not yet officially declared their intentions. The application period is expected to open in Fall 2022.

The hydrogen economy is slowly gaining ground as private and public sector interests look for alternatives to fossil fuels; it is an especially notable solution for hard-to-decarbonize sectors or places with low possibilities of renewable energy integration. While hydrogen is not yet as ubiquitous as traditional renewable technologies, nor has the same level of resounding support, the growing prevalence of hydrogen in energy policy demonstrates a trend that is here to stay.