By: Ethan Beaulieu, Energy Policy Intern

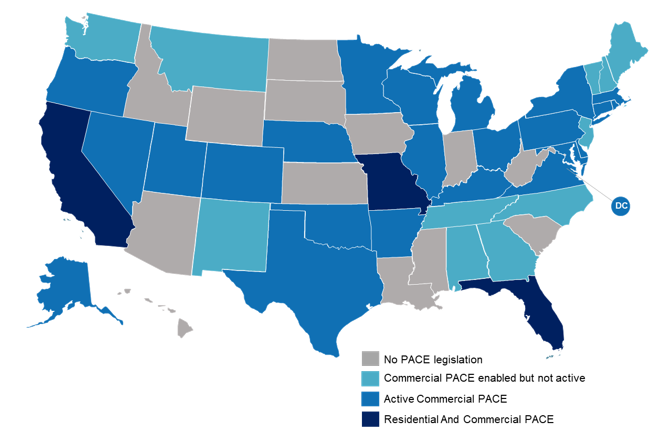

The model for property retrofitting loans known as Property Assessed Clean Energy or PACE, originated in California in 2008. The program quickly gained popularity and was introduced throughout the state. Currently, PACE has a legislative basis in 37 states, with 26 states having active programs. R-PACE or Residential PACE is only offered in California, Florida, and Missouri. Over the past decade PACE, and in particular R-PACE, has become subject to significant public criticism, suffered a decline in participation, and even termination of the program in some municipalities. The R-PACE program, once lauded by President Obama and at the time Vice President Biden as a boon to energy efficiency home improvements for low-income homeowners, has become tainted by a lack of consumer protections, reports of aggressive contractors, and deceptive loan practices. Still, PACE programs continue around the country and Commercial PACE (C-PACE) programs continue to expand to new municipalities. The twin programs R-PACE and C-PACE are still argued by some as being a way encourage shifts to clean energy while minimizing government subsidies and utilizing market mechanisms. The latter half making the switch to renewables significantly more palatable to some.

Status of PACE Financing by State (2021)

So What Exactly is PACE?

PACE programs exist in two forms: C-PACE or Commercial PACE for businesses, and R-PACE or Residential PACE for homeowners. While these two programs differ significantly, they share a core structure and intention. PACE programs allow property owners to finance the upfront cost of energy and other eligible efficiency related improvements through a fixed interest rate lien that is paid off over time in the form of an added tax assessment. These typically range between 5 to 25 years in length. One of the unique characteristics of this financing tool is that the assessment (loan payments) is attached to the property. Thus, if a property were sold, the assessments will fall to the next property owner. These programs typically are only used for existing structures. It is also important to note that state law provides that these liens have a superior priority status over mortgages. Since the lien payments are tax assessments, failure to pay these could result in tax foreclosure of the property. In such cases, the PACE loan providers have first dibs to funds generated from the foreclosure, ahead of previous mortgage lenders.

From a policy perspective, PACE programs are state legislated initiatives that authorize counties or municipalities to create a financing mechanism for home energy improvements, utilizing private parties to administer it. The program lends to homeowners for eligible products and services through approved contractors at fixed interest rates. In order to attract private lenders, their loans are imposed as a tax assessment on the property, giving the lenders superiority over mortgages and thus being an incredibly safe investment for them. It is important to highlight that PACE loans are not a second mortgage or equity lending, and the maximum loan amount is determined as a portion of the assessed property value (generally around 15-20%).

The Benefits

As mentioned before, PACE loans offer a way for businesses and homeowners to get energy efficiency or eligible improvements with no upfront cost. In theory, the cost of improvements are offset by the savings generated from the efficiency improvements. This is in part why the loan terms are so long. Another benefit is that since the lien runs with the land, the cost can be passed from one owner to the next. This addresses the very valid concern of investing in energy improvements, but not staying with the property long enough to pay off the initial costs.

For investors and lenders, both Commercial and Residential PACE bonds and loans prove to be a very high security investment due to their special priority status of mortgages.

Residential PACE Loan Hazards

Since their inception, PACE loans have been plagued with controversy. A well-intentioned program even championed by former President Obama and sitting President Biden, still exposes borrowers to extensive risk and undermines aspects of the housing finance system.

R-PACE loans in particular have proven to be dangerous due to their marketing to low-income households as a safe way to retrofit your home with money saving, environmentally-friendly improvements. However, R-PACE has few consumer protections at the federal level and inconsistent protection among states. Commercial PACE programs have even fewer protections at the federal level as they were explicitly excluded in 2019 Consumer Finance Protection Bureau (CFPB) regulatory changes. These and other related regulations will be discussed later.

Often, R-PACE loans are marketed through door-to-door sales and telemarketers, which fundamentally pose a risk for deceptive sales tactics due to the expeditious nature of the interaction. This, in combination with applications being approved and signed electronically and/or through a phone call, makes abuses that much easier. Additionally, because your eligibility for PACE loans is determined as a portion of your assessed property value, your ability to pay off the loan can in many cases not be considered. On top of this, state laws provide for localities to collect up to 10% of the loan amount in administration fees. The combination or rolling administration fees, frequently above market interest rates, lack of consumer recourse in case of workmanship issues since contractors are partnered with PACE providers, inadequate disclosures, indiscriminate lending, and generally lagging regulations can end up with homeowners unwittingly signing up for improvements that never pay themselves off and in worst-case scenarios, lead to foreclosure. R-PACE especially fails to protect owners from unscrupulous lenders and aggressive contractors in the ways that normal lending and finance protections would.

Risk and Unfair Advantages of the Superior Lien

As mentioned before, PACE loans are paid off in the form of an attached property tax assessment that runs with the land and has the unique characteristic of being super-priority over all other lien holders. Meaning, if the property owner fails to pay the assessment and it goes to foreclosure, they get to cut to the front of the debt collection line and collect their proceeds. This means that PACE loans are very secure investments, but only at the expense of existing lien holders who did not consent to the new lien and now face an increased risk of loss. In a 2010 response to this, the Federal Housing Finance Agency (FHFA) directed mortgage underwriters Fannie Mae and Freddie Mac to stop purchasing and refinancing mortgages on properties with PACE priority liens. This had a massively depressive effect on R-PACE loans, which now only exist California, Florida, and Missouri. The Fannie Mae and Freddie Mac advisory does not include C-PACE loans. The unfortunate side effect is that those who have existing PACE liens may have a difficult time selling their property.

Regulatory Responses

In a 2018 response, Congress enacted amendments to the “Truth in Lending Act” (TILA), which effectively applied the federal standards of loan regulation to PACE, since they had not been before. The CFPB was tasked with the implementation of this law. In 2019, the CFPB published an Advanced Notice of Proposed Rulemaking on R-PACE that among other things, specified that loan providers must ensure TILA’s ability-to-repay (ATR) requirements applied to R-PACE and established procedures for violations of such requirements. It should be noted that this applies only to Residential PACE and not to Commercial PACE. In terms of state regulation of PACE programs, regulation is largely dependent upon the given state and municipality. Some states that offer R-PACE have made significant efforts to protect consumers in recent years, most notably California. Still PACE programs are far less regulated as a whole compared to similar lending options.

The Verdict

Are PACE loans right for you? If you’re a low-income household looking to make energy efficiency improvements, the answer is probably no. PACE interest rates currently aren’t competitive and provide greater risk to the consumer. Even if they were safer, low-income households are also likely eligible for free energy efficiency improvements through programs like the federal Weatherization Assistance Program or other lower cost options. It is important to make sure that you are aware of all available programs before making a decision, particularly if the PACE program being pushed to you is through a door-to-door salesperson.

If you are a business or high-income individual looking to retrofit your home, C-PACE or R-PACE may still be a good option for you. The benefit of being able to pass on the lien is a huge benefit for businesses who want to reduce their environmental impact, but don’t want to risk a massive investment in a potentially temporary property. Similarly, high-income individuals could use this to increase property value. It is always recommended to get an energy/water audit before the homeowner selects their improvement, but it is not required. Some may even knowingly accept that the improvements may not pay for themselves, but still provide the benefit of reducing their impact on the environment.

While PACE has significant pitfalls, it is a well-intentioned plan that perhaps with more finetuning could see a return to popularity. When considering a PACE lien, always make sure to take your time and deliberate whether the benefit of retrofitting and value of reduced environmental impact account for the risk.