By: Ethan Beaulieu, Energy Policy Intern

As the dust in Washington settles around the infrastructure bill, attention has turned to the proposed budget reconciliation bill (“Build Back Better” plan), which includes a variety of investments and incentives related to clean energy. Senator Joe Manchin of West Virginia has been a major critic of the Biden administration’s Build Back Better plan for a number of reasons, including his state’s heavy reliance on coal for both energy generation and economic productivity. The razor thin Democratic majority in the Senate has made Senator Manchin an essential vote for the reconciliation bill’s passage, amplifying his influence over its contents.

Senator Manchin’s trepidation about proposed items like the Clean Energy Performance Program, which would have rewarded power companies for increasing the portion of renewables by a set amount each year and penalizing those who don’t, is not without basis. West Virginia has long been considered coal country, producing the second greatest amount of coal in the U.S. after Wyoming, and coal-fired power plants accounting for almost all of West Virginia’s electricity generation. With such heavy reliance on coal as both a consumed and exported product, and a local history and culture surrounding its production, Manchin is caught between the party priority and constituency obligation. Nationwide, coal has been in significant decline since its U.S. consumption peak in 2007, but still accounts for the vast majority of electricity generation in West Virginia. In the following, we will work to understand exactly how reliant West Virginia is on coal, as well as look at sources of the decline and steps taken towards energy diversification.

A Brief History of Coal in West Virginia

Coal has long been a known resource in West Virginia. The first mine reportedly opened in 1810, but was used largely for local consumption into the early to mid-nineteenth century. As railroads spread throughout West Virginia, the commercial coal industry began to grow, and in 1883 major rail lines were completed bringing the production that year to total almost 3 million tons. Coal became a dominant economic force in West Virginia, peaking in 1997 with 181,914,000 tons produced. The Appalachian Plateau region holds much of the state’s coal, though crude oil and natural gas wells also exist in the area. As of now, West Virginia is the nation’s fifth largest energy producer, providing a net total of 5% of the nation’s energy, the majority of which comes from coal-fired power plants.

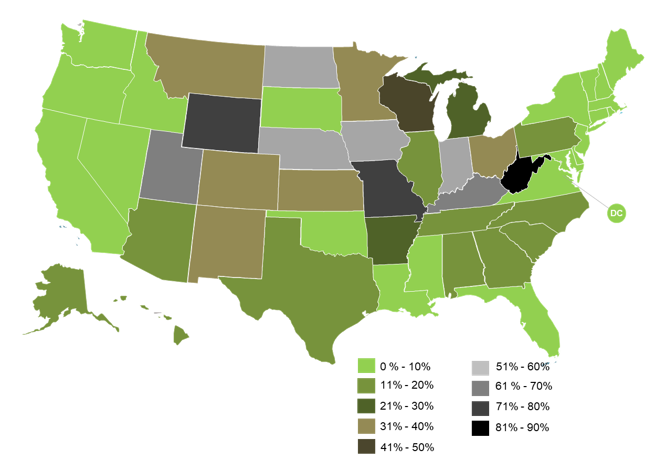

Proportion of State Electricity Generated by Coal

The State of Coal

In 2019, West Virginia was responsible for over one eighth of the nation’s coal production. The state continues to be the largest producer of bituminous coal, the most common type in the U.S.. West Virginia consumes only a quarter of the coal produced with the remaining three-quarters being shipped largely to a collection of 20 states, as well as foreign markets. Unlike domestic trends, international demand has been extremely volatile in recent years. Coal exports from West Virginia fell from $7.9 billion in 2012 to $1.4 billion in 2016, only to reach $4.5 billion in 2018 before falling again to $2.2 billion in 2019. While the overall trend has been downward, the rate of the drop is inconsistent. In terms of consumption, West Virginia generates electricity almost entirely from coal-powered plants, with eight of the state’s ten largest power plants being coal-fired. As of 2020, 89% of electricity in the state is generated by coal compared to 19% nationwide.

The Decline of Coal

To those both in West Virginia and outside the state, the decline of coal has been apparent in recent years. Last year, Longview Power LLC filed for Chapter 11 bankruptcy protection because of lessened demand for electricity due to growing competition from natural gas, an unusually warm winter, and pandemic impact. Employment by the coal industry fell by 54% between 2005 and 2020, with the counties having the greatest dependence on the industry facing the most severe losses. Tightening pollution regulations have forced American Electric Power’s (AEP) West Virginia coal-fueled power plants to undergo $448 million in upgrades to remain federally compliant through 2040 rather being shut down in 2028. The upgrades are projected to increase electricity rates by 3.3% in September of 2022. This is on top of AEP’s cumulative rate increase of 122% over the past 13 years. Despite the increase in price to consumer and producer alike, coal consumption has dropped marginally compared to the national average. West Virginia’s coal use in energy production dropped only from 98% in 2001 to 89% in 2020, versus the 52% to 19% nationwide.

Coal production in West Virginia has dropped more considerably, with a 65% decline between 2005 and 2020. The decrease stems from a combination of national and local factors including new regulations which have increased the cost of coal production and usage, a reduction in coal mining productivity from decades of aggressive mining in Central Appalachia making the remaining coal more expensive to extract compared to other coal basins, and increased competition from natural gas as a source of fuel for the power industry.

What Comes After Coal?

Given the broad decline in coal use, heavy reliance on coal as a source of revenue, employment, and energy generation faces threats to long term viability. So, what has West Virginia done to address this issue? In 2009, West Virginia enacted a Renewable Portfolio Standard (RPS) requiring investor-owned utilities and retail suppliers with over 30,000 customers to produce 25% of their electricity from alternative and renewable energy resources by 2025. It should be noted that West Virginia allowed non-renewable resources like coal technology, coalbed methane, and natural gas to meet the RPS goals. Despite this lax requirement, West Virginia repealed its RPS in 2015.

Aside from the now-repealed RPS, West Virginia has made some progress in terms of utilizing other energy resources. Senate Bill 583 created the state’s first utility solar program, allowing American Electric Power and First Energy to install 200 MW of solar capacity in 50 MW increments. In 2021, state lawmakers enacted legislation authorizing the use of third-party power purchase agreements for on-site solar generation. In 2019, coal accounted for the smallest portion of the state’s electricity generation at close to 89%. Natural gas reached a record amount of 3% of net generation, while hydropower and wind each accounted for approximately 3%. Hydroelectric generation has nearly doubled in West Virginia in the past 20 years with the operation of a new 44 MW plant in 2016.

While West Virginia has made some progress towards energy diversification in the last decade, growing regulations on carbon emissions and broader energy market trends threaten the bedrock of the state’s electric generation. If current trends continue, West Virginia is likely to face increased unemployment affecting rural areas the most, continuously rising electric utility rates, and potential energy insecurity. A silver lining to West Virginia’s predicament is that energy sources have started to see a more even playing field. This opportunity opens the door for renewable energy to provide jobs to areas that had once been provided by the coal industry. Companies like Nitro Construction services, which was originally oriented towards the coal industry, have begun working in the solar business. As coal takes up less of the market, the opportunity for West Virginia to become a leader in clean energy emerges.