By: Mike Cahill, Redfin

While winter brings the holidays, sweaters and scarves, and cozy nights curled up by the fire, this blustery season also brings harsh conditions that can wear at the exterior of your home. That’s why it’s so important to ensure your home is prepared to weather the winter season in an environmentally conscious manner. So we reached out to the experts in eco-friendly home winterization practices from Hawthorne to Castle Hills to provide you with some tips for winterizing your home in 2020.

Harness solar energy year-round

When people think of solar energy they, naturally, focus on months with a lot of sunny days. The truth is that a large part of the year the days are shorter and a bit less sunny.

While it’s true that the summer will get you a much larger piece of the annual solar production, there is a place for solar energy in the winter months. If the home is powered through non-electric sources there is an overall reduction of electricity used in the home. This coincides with the cutback in solar energy generation, so they line up nicely.

When the weather is cold it cools down the panels, which increases the voltage. This allows the panels to produce more electricity, per sunny hour, when compared to a summer month. The cold decreases Electric Resistance. This makes solar production more efficient while working with less sunlight. – PowerLutions Solar

One of the ways you can optimize your home during the winter is to install solar. There’s a misconception that solar only works well during the summer, and that’s not quite true. Solar works well whether it’s summer or winter because we use energy constantly throughout the year. During the hot summer months, your solar panels overproduce energy, which means that you’ll have extra, cleaner energy during the cloudy winter months to help reduce your energy bill. Another benefit of going solar is to take advantage of current Federal Tax Credits to help reduce the cost of the solar system. However, keep in mind that these Federal Tax Credits are going away soon, so make sure you take advantage of it now to save even more money while it’s still available. – James the Solar Energy Expert

When it comes to installing solar panels in the winter, many homeowners don’t realize that this is probably the best time to get it installed. The reason being, many homes utilize gas to heat their homes in the winter months. As a result, electricity usage is generally much lower than the summer and allows homeowners to build up “net metering” credits. These credits can then be used in the summer when electricity usage tends to be higher due to running your air conditioner and allows homeowners to not have low summer electric bills. – Enlyten Energy

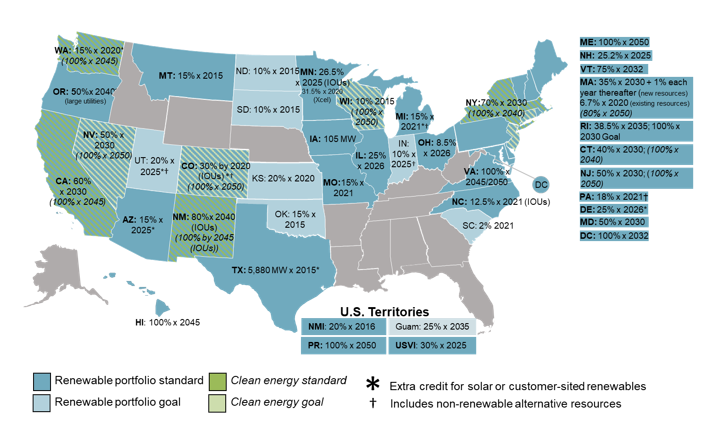

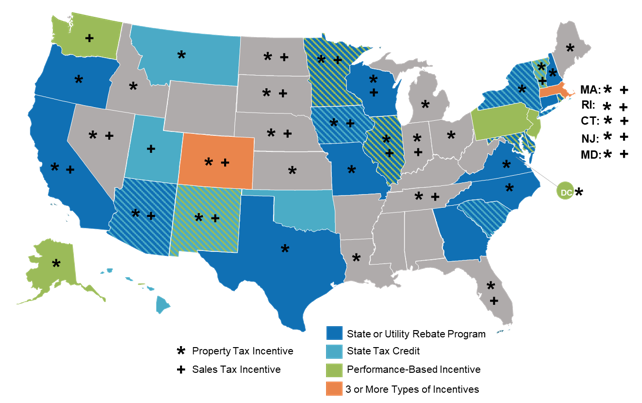

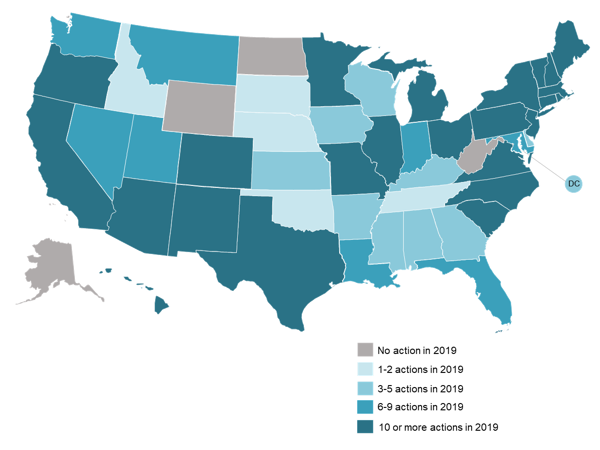

Learn what solar can do for you

Many electric utility companies across the country offer free or subsidized home energy audits that can reveal the most valuable efficiency improvements for your home. Many utilities also provide rebates or financing to help purchase new energy-efficient equipment or solar panels. The DSIRE website provides information about all the available financial incentives for energy efficiency and renewable energy in all 50 states. Simply enter your zip code on the homepage to see them all. – DSIRE

Swap out gas for electric

Replacing your old gas boiler with an electric heat pump will help reduce methane and CO2 emissions. Because of the improved energy efficiency of heat pumps, you will likely save money over the lifetime of the new equipment when compared to the cost of replacing your gas boiler, especially if you combine the system with a ground or water source heat loop. Be sure to combine your electrification investments with smart thermostats so you are ready to be a part of the residential demand response solution that will support our renewable energy transition. – Land Art Generator

Ensure your windows are up to date

One great way to save energy during our winter and summer months is to replace any older windows. Over the last ten years window efficiency has increased tremendously. If your windows are over ten years old it will make a massive difference replacing them. Another way to help with efficiency is by insulating your attic space. R60 or 20” of insulation is the recommended level for blown-in insulation. Most of the older homes we inspect are not insulated properly and have 10” or less of insulation. This can make a large difference in energy efficiency. At All Seasons Exteriors, we also install the best and most eco-friendly shingle on the market which is Malarkey shingles. All the shingles we install are rubberized and impact resistant. They also have smog reducing granules in them. These granules react with UV rays and pull smog out of the air. Every roof we install is the same as planting 2-3 full-grown trees. NO other manufacturer uses these granules in their shingles. Remember there is always a reason to call All Seasons… – All Seasons Exterior

The weakest link in a building’s envelope (walls, floors and ceilings) is generally the windows. Replacing them with the highest performance windows you can find and making sure they are installed properly – weather and airtight is critical – will make a tremendous difference in the comfort/livability and energy efficiency of a home. Note also, some manufacturers can tune the windows to the sun’s orientation with high solar gain on the south and varying options on the east, west and north sides to optimize their performance. Note that windows and doors are not all the same and one aspect is the air tightness. If the manufacturer isn’t able to provide their air infiltration rating, look elsewhere. – AE Building Systems

Regulate your home’s humidity

Winter brings lower temperatures and lower indoor air humidity. Keeping the indoor air humidity at 30-40% minimizes the forced air heating costs, prevents hardwood and solid wood furniture from drying out, and greatly improves breathing comfort and air filtration efficiency. Make sure that circulation of the warm air near the windows is not restricted by shutters or heavy blinds, otherwise, the inner surfaces of the windows may go colder than the dew point and start producing excessive condensation. Besides working against your humidifier and sucking the moisture out of the air, condensation leads to unsightly puddles that damage the window sills and, if mixed with dust, create a perfect breeding environment for mold. – Aztech Doors & Windows

If you live in an area with dry winters, we recommend maintaining some humidity in your home. You can add room humidifiers or even a whole house humidifier, but plants are also a great way to add humidity to your home. Plants gradually release moisture into the air, help trap heat, and can be great design pieces. Adding moisture to the air during winter is not only good for the wood elements of your home, it makes your home’s air more breathable and is great for skin health. – Invalesco Real Estate

Check and replace faulty weatherstripping throughout

Your windows and doors can be a big reason for air leakage. Check and replace weatherstrip around windows and doors once a year. Oftentimes the wear and tear can cause weatherstrip to lose its effectiveness. In some cases, the better solution is to upgrade to new Energy Star rated windows with a .30 U factor or less. In the process of replacing the window, the Certified window installer can ensure proper insulation is installed between the window and the home’s framing, further reducing air leakage around the windows. – Lake Washington Windows & Doors

To prep, your home for winter the biggest challenge and the best bang for your investment buck is to seal any cracks where cold winter air may enter, add blown-in fiberglass or cellulose into your attic (if you have one- some homes have cathedral ceilings), and especially find convenient, attractive and inexpensive ways to insulate all windows at night, especially the larger ones. This is called “moveable insulation,” or “nighttime insulation.” Sometimes windows lose more heat on cold and long winter nights than the rest of the house combined! – Crestone Solar School

Look out for sagging doors

The top hinge bares most of the weight of the door and over time the door will tend to pull away from the hinge-side frame. This can result in the top of the door rubbing against the frame on the lock side. It can also affect the weather seal. To correct this the first step is to tighten hinge screws that may have loosened. If they’re tight, remove 1 or 2 of the screws from the top hinge, replacing them with 3″ screws that will bite into the studs behind the door frame/jamb. This will pull things toward the stud, straightening the door. If that doesn’t work, try putting a shim (something the thickness of a cereal box) behind the bottom hinge. Kicking out the bottom can straighten the door in its frame. – Door Renew