By: Justin Lindemann, Senior Policy Analyst

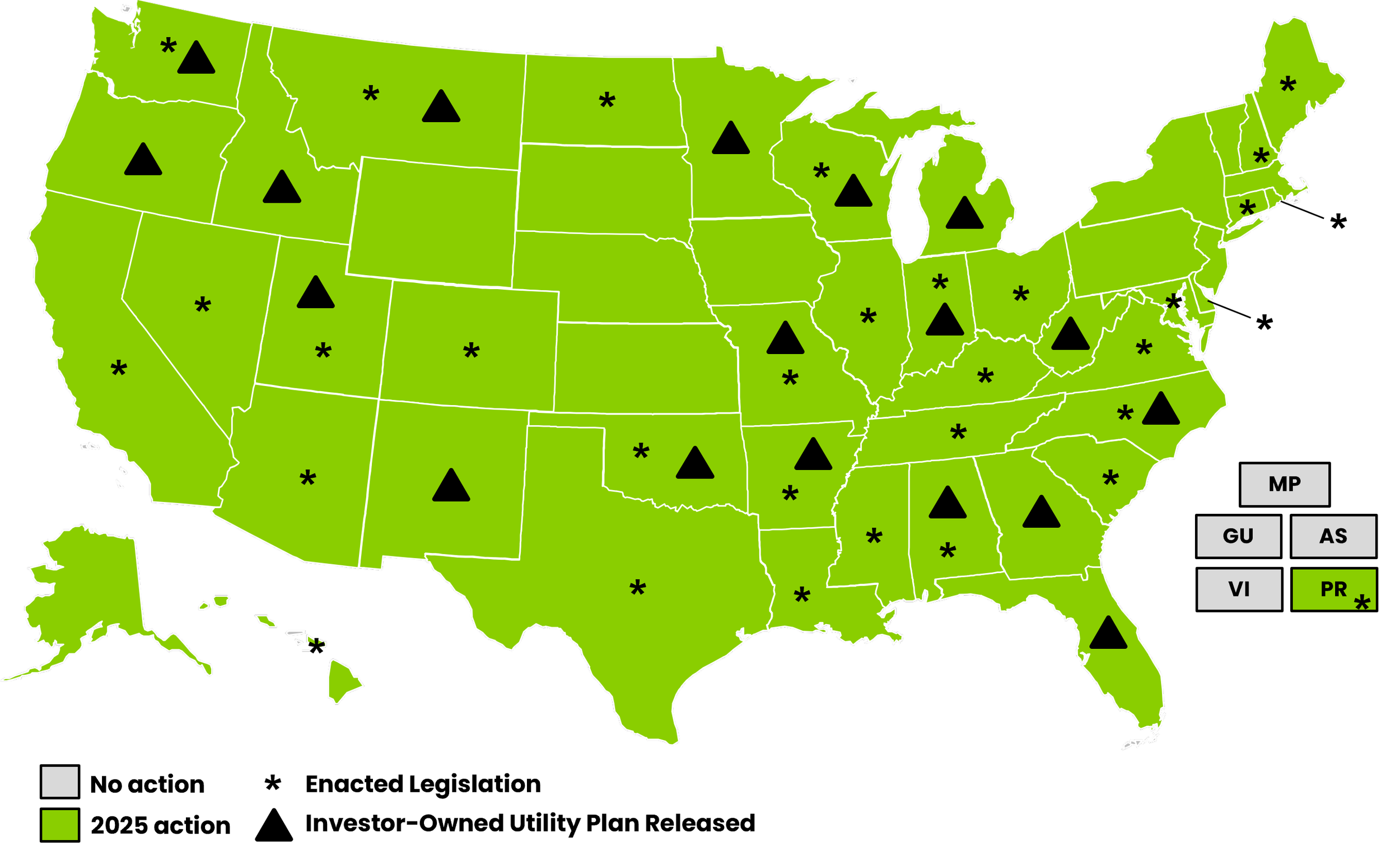

2025 marks another year of notable progress and further steps toward deploying new nuclear technology and developing advanced nuclear infrastructure. As in recent years, especially the last three, 2025 saw significant federal and state progress, with the executive branch removing substantial barriers for constructing the next generation of nuclear. Utilities have begun responding to government support at various levels with their own plans, some aiming to address increasing loads and others taking concrete steps toward deployment. The market continues to support the prospects of new nuclear projects, while previously decommissioned reactors gain new relevance. In 2025, all 50 states and Puerto Rico had actions (i.e., legislative, executive, regulatory, and electric utility actions) relating to new nuclear, compared to 43 states and Guam in 2024.

Stateside Progress

Legislative Actions

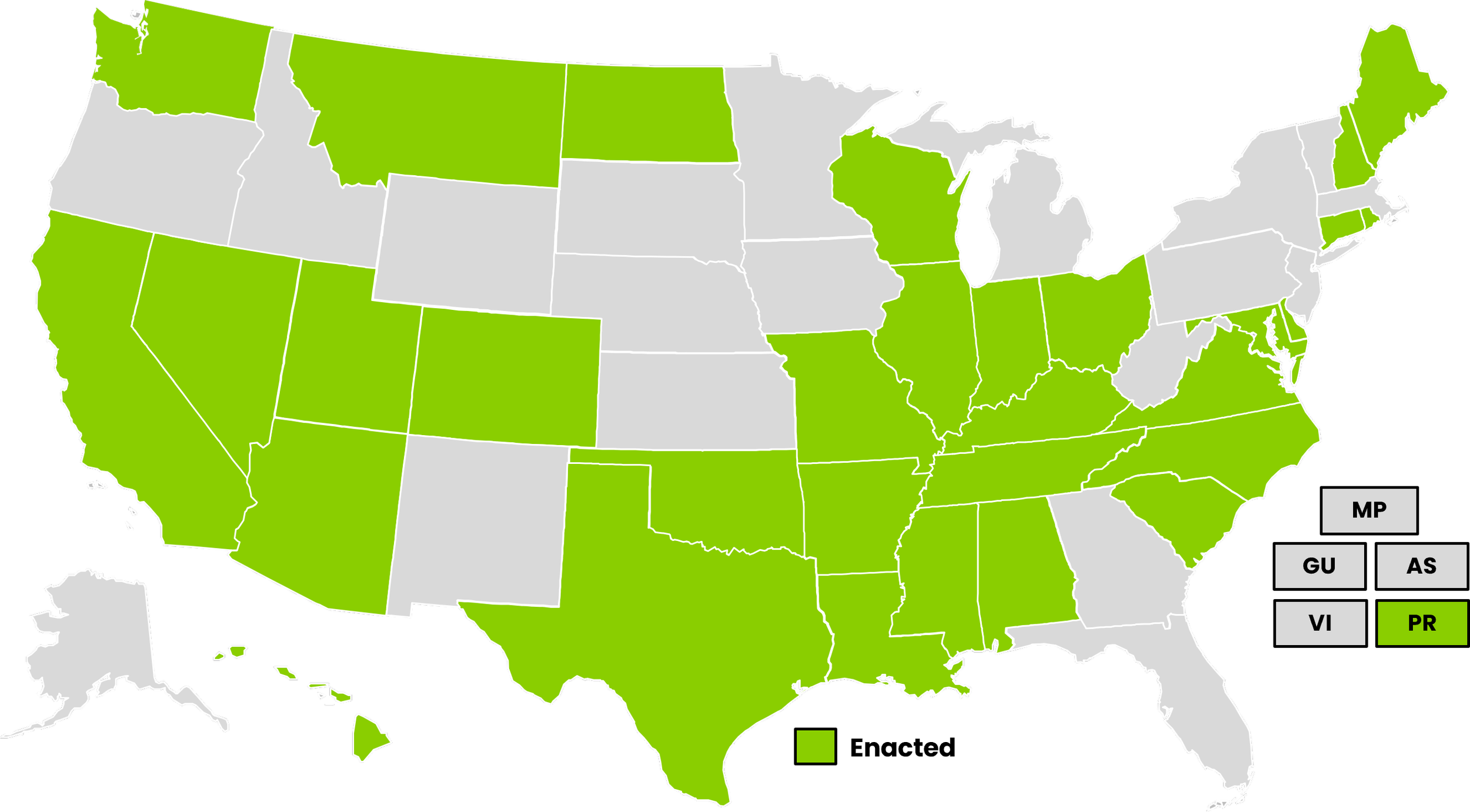

Stateside, at least 261 bills and resolutions affecting the future development of advanced nuclear technologies were introduced in state legislatures nationwide in 2025, as many two-year sessions began anew—from Illinois to Massachusetts. This represents a significant increase compared to previous years: an estimated 109 bills/resolutions were introduced in 2024, with 18 enacted, and an estimated 81 were introduced in 2023, with 28 enacted. In 2025, the number of enacted bills far outpaced last year, with a staggering 57 enacted.

Washington led with H.B. 1018, adding fusion energy to its existing siting framework and becoming one of the first states to explicitly include the technology after bipartisan approval and a May signing. Wisconsin followed by enacting legislation creating a statewide Nuclear Power Summit to bolster education, coordination, and information-sharing while highlighting the state’s nuclear manufacturing legacy. It also enacted S.B. 125, directing the Public Service Commission to complete a comprehensive siting study of advanced nuclear and fusion technologies within 19 months, assessing opportunities at existing and new sites, incorporating U.S. Department of Energy coal-to-nuclear research and U.S. Nuclear Regulatory Commission timelines, and developing statewide siting guidance.

Texas saw significant policy advancements as well with H.B. 14, creating the Texas Advanced Nuclear Energy Office to coordinate the state’s transition to advanced reactors—spanning large Gen III+ units, small modular reactors (SMRs), microreactors, and cogeneration. The bill also launched the Advanced Nuclear Development Fund, offering early-stage support and construction grants of up to $100 million, plus completion bonuses tied to ERCOT interconnection. A companion workforce measure was also enacted, as the state expands its clean energy sights on nuclear.

Other states followed with targeted incentives. Louisiana enacted legislation directing its state environmental agency to establish a “federal permitting parity” program to expedite SMR permitting, similar to Texas. Indiana’s H.B. 1007 created a 20% SMR manufacturing tax credit, including hydrogen-capable designs, while Kentucky signed into law an $8 million Nuclear Energy Development Grant Program to support activities from fuel fabrication to decommissioning. Tennessee’s H.B. 1133 added nuclear to its certified green-energy facilities incentive and established a sales-tax exemption for uranium-enrichment and conversion infrastructure, strengthening its fuel-cycle sector.

Several states pursued feasibility studies and exploratory efforts to advance themselves as potential leaders within the domestic nuclear market. Oklahoma’s S.B. 130 requires a contracted study of the technical, legal, and economic feasibility of nuclear—including SMRs and microreactors—covering workforce needs, siting, environmental impacts, supply-chain readiness, and policy reforms, with results due in nine months. Both of Puerto Rico’s legislative chambers passed resolutions initiating a similar assessment of potential SMR deployment on the island. North Dakota, Delaware, and others likewise moved ahead with studies or working groups. Multiple states also issued declarations or launched workforce and policy initiatives: New Hampshire’s state legislature urged expedited federal licensing and expanded training programs, while Wisconsin, South Carolina, Louisiana, and Hawaii advanced comparable resolutions or study groups examining advanced nuclear opportunities.

Major carbon-policy shifts accompanied these efforts. North Carolina’s S.B. 266 removed the state’s 2030 emissions-reduction target, retained the 2050 neutrality goal, and enabled utilities to recover certain early baseload generation costs—including for nuclear—outside the traditional rate case process; the legislature enacted the measure over a gubernatorial veto, while Missouri and Arkansas advanced similar policies. Maine updated its renewable portfolio standard, creating a new Class III clean-energy category that includes nuclear energy.

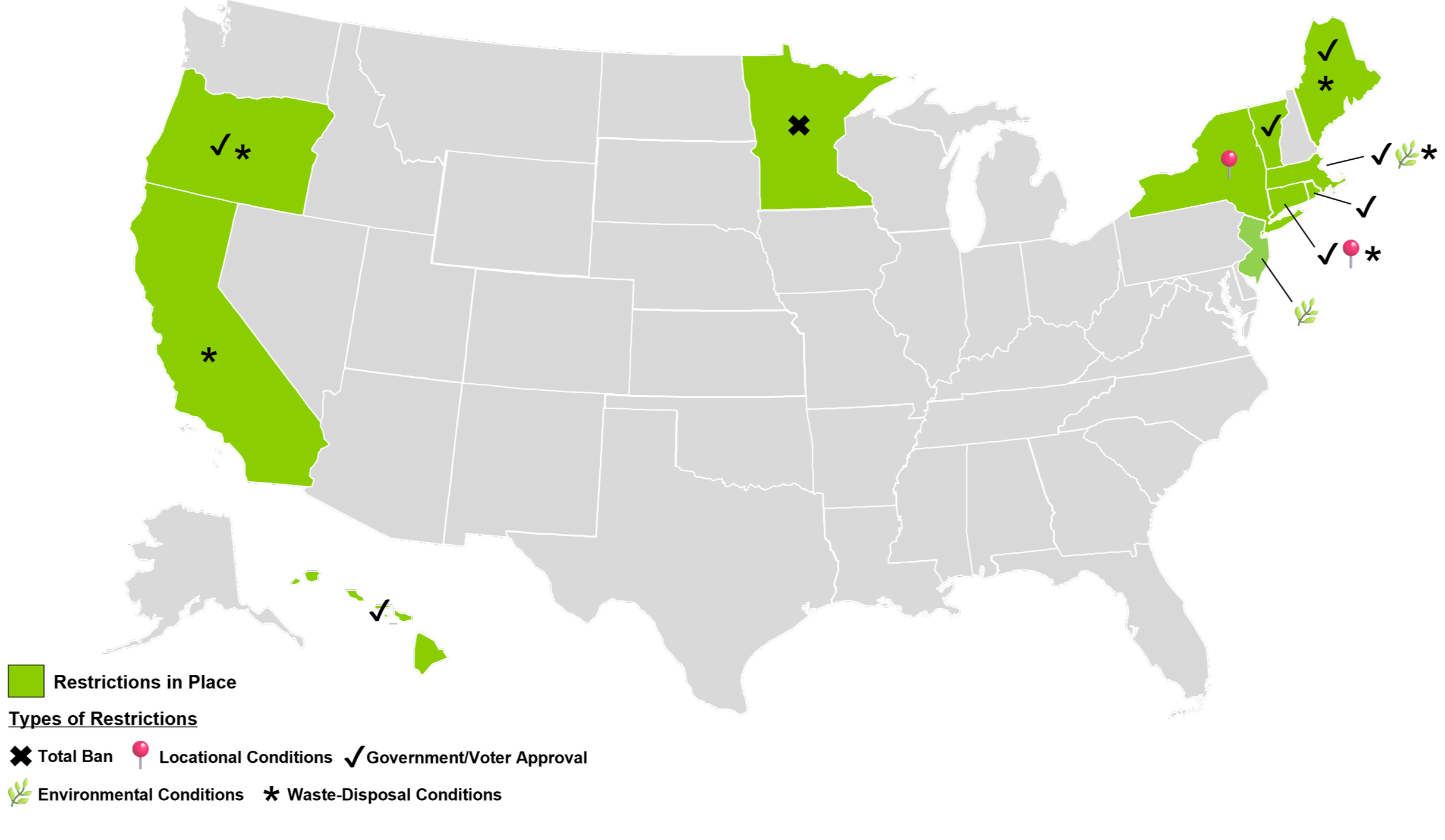

Two states made landmark strides against long-standing nuclear moratoria. Connecticut’s S.B. 4 now allows advanced reactors at existing nuclear sites if a federally approved waste-disposal pathway exists and municipalities grant construction consent. Meanwhile, S.B. 25 in Illinois made its way to the governor’s desk—where it was signed at the start of 2026—and ended the state’s decades-old moratorium on reactors larger than 300 MW and removing all statutory references to SMRs, which had been added two years earlier, thereby opening the door to reactors of any size. The gradual, supportive swing in the midwestern state may be a model for how others can shed legislative apprehension about the clean, firm energy alternative.

Map (above) of states that have enacted a bill or resolution in 2025 related to advanced nuclear technologies. (Source: Justin Lindemann, NC Clean Energy Technology Center)

Studies and Reports

Utility regulators, state agencies, and specialized groups have released a wide range of studies this past year, many of which highlight the growing role of advanced nuclear technologies in regional economic development, energy security, and long-term planning. Some reports lay out the economic potential of advanced nuclear in specific parts of the country, while others position particular states as emerging leaders in the new nuclear landscape.

In Appalachia, the Atlantic Council’s Atoms for Appalachia report argues that advanced nuclear could help revitalize the region by repurposing former coal sites, accelerating clean manufacturing, and creating high-wage, local professions. The study highlights West Virginia—newly stripped of its nuclear ban—as a particularly strong contender for supply-chain growth, while emphasizing the need for coordinated state action, federal support, and more predictable regulatory processes.

North Carolina’s latest installment of The Future of North Carolina’s Energy Economy reaches similar conclusions, finding that the state is increasingly attractive for capital-intensive energy projects, including advanced reactors. The report points to ongoing work in the coastal city of Wilmington to build a second fuel-assembly facility that will supply TerraPower’s first commercial reactor in Wyoming, expected to begin operating in the early 2030s.

States far beyond Appalachia are also staking out positions. South Dakota’s Resilience and Infrastructure Task Force has urged a closer examination of nuclear energy as part of a long-term, all-of-the-above strategy. In Idaho, the Governor’s Office released an Advanced Nuclear Strategy Framework aimed at strengthening the state’s energy foundation—proposing a dedicated fund for nuclear initiatives, more efficient permitting through the newly formed Strategic Permitting, Efficiency, and Economic Development (SPEED) Council, and deeper collaboration with regional partners through the Intermountain West Nuclear Energy Corridor Tech Hub.

Map (above) of states with nuclear energy restrictions in place as of January 2026. (Source: Justin Lindemann, NC Clean Energy Technology Center)

Regulators are shaping nuclear’s momentum as well. The National Association of Regulatory Utility Commissioners (NARUC) and the National Association of State Energy Officials (NASEO) jointly issued new guidance to help states integrate advanced nuclear into their planning and regulatory processes. In Florida, the Public Service Commission’s final advanced nuclear feasibility report—released in late March—echoes support for further evaluation into statewide nuclear development and support for cost-shifting protections in cases where SMRs serve data centers, among other large loads. The report recommends that lawmakers commission a broader study of nuclear energy’s statewide role, expand eligibility under alternative cost-recovery provisions, strengthen public engagement and education, support new grant opportunities, and invest in workforce development.

Fusion has also gained some national attention as a federally recognized advanced nuclear technology. The U.S. Department of Energy’s Fusion Science and Technology Roadmap released during the year, outlined a coordinated push to accelerate domestic progress, from new research and development infrastructure and advanced modeling tools to expanded public-private partnerships and workforce training—positioning fusion as a longer-term complement to the more traditional fission-based nuclear development.

On the national stage, the Commission on the Scaling of Fusion Energy released its Fusion Forward report, calling for fusion to be recognized as a national-security priority and urging the federal government to break ground on multiple industry-led fusion demonstration plants by 2028. The Commission argues that sustained leadership will require clearer regulatory pathways, stronger supply chains, and a workforce capable of supporting long-term commercialization.

Local efforts are advancing as well. San Diego’s Regional Energy Management Council released a fusion roadmap, emphasizing the region’s early leadership, with a growing industry cluster and significant private investment. The study suggests that a commercial fusion sector could one day support tens of thousands of jobs and generate major economic activity, but warns that regulatory uncertainty and high infrastructure costs remain as barriers.

Breaking Barriers at the Federal Level

2025 was also the year that the federal government undertook an unprecedented suite of initiatives to accelerate nuclear energy deployment, streamline regulations, expand domestic fuel production, maintain incentives, and strengthen workforce and supply-chain capacity. These measures—carried out through executive orders, legislation, interagency agreements, and targeted funding—represent the most comprehensive federal push toward new nuclear energy.

Early in the year, the administration established the National Energy Dominance Council to advise on strategies for boosting U.S. energy production, including uranium mining, reopening idle plants, and bringing SMRs online. This effort was paired with an executive order under the Defense Production Act to expand domestic mineral extraction, strengthening the upstream supply chains critical for nuclear deployment.

Image (above) of the Palisades Nuclear Plant in Covert, Michigan. (Source: Holtec International)

In May of last year, a landmark string of executive orders formalized the expansion of nuclear energy as central to U.S. policy. It directed the Department of Energy (DOE) to develop national strategies for spent fuel management, advanced fuel cycles, and domestic uranium enrichment, while ensuring at least five GW of uprates at existing plants and the construction of 10 new large reactors by 2030. The order also emphasized coordination with the Department of Defense to explore the reuse of closed nuclear facilities as microgrid power hubs and instructed the DOE and Small Business Administration to expand funding for near-term advanced reactor deployment. Workforce development became a central focus, with nuclear careers designated as high-priority fields and federal agencies directed to expand apprenticeships and Career and Technical Education (CTE) programs.

The DOE’s reactor testing framework was also amended, with the aim of accelerating advanced reactor deployment. It established clear definitions for test reactors, reformed regulations to allow operation within two years of application, and launched pilot programs to construct reactors and achieve criticality beyond national lab sites, all coordinated across federal agencies to ensure a unified approach.

Simultaneously, the Trump administration called for a comprehensive restructuring of the Nuclear Regulatory Commission (NRC) to support a national goal of increasing U.S. nuclear capacity from roughly 100 GW in 2024 to 400 GW by 2050. This included licensing reforms with strict deadlines for new applications and renewals – 18 and 12 months, respectively – bulk licensing for modular reactors, and updated radiation and National Environmental Protection Act standards. Organizational changes streamlined the NRC, narrowed review scopes, and reduced staffing to focus on rapid, risk-informed decision-making.

Congress complemented these efforts through H.R. 1, which maintained tax incentives for advanced nuclear facilities and restricted credit incentives for certain foreign entities. The legislation also formally recognized energy communities historically tied to nuclear employment.

Federal agencies pursued coordinated actions to accelerate deployment and build industry capacity. The DOE and the NRC signed a memorandum of understanding creating an expedited licensing pathway that leverages DOE safety analyses. At the same time, strategic agreements with Japan and private-sector partnerships unlocked hundreds of billions of dollars in investment for AP1000s and SMRs. DOE also launched workforce grants and advanced fuel-line pilot programs, selected reactor projects for the Reactor Pilot Program, and supported private-sector fusion research through initiatives such as the Fusion Innovative Research Engine (FIRE) and the Innovation Network for Fusion Energy (INFUSE). A Defense Production Act consortium was also formed to strengthen domestic nuclear fuel supply chains from mining through reprocessing.

Regulatory progress under the NRC last year included significant movement on new combined license applications for AP1000 reactors, approval of factory-loaded microreactors, extensions of design certifications from 15 to 40 years, and a revised fee schedule offering reduced rates for advanced reactor applicants.

The Trump administration closed the year with another executive order launching the Genesis Mission, a national initiative intended to usher in a “new age of AI-accelerated innovation and discovery.” The mission aims to accelerate the application of artificial intelligence to transformative scientific breakthroughs that address significant national challenges, including, but not limited to, advanced science and technology priorities such as nuclear fission and fusion energy.

Together, these federal actions in 2025 established a coordinated and national framework for nuclear energy—supporting the spectrum of advanced nuclear technologies, expanding domestic supply chains, and creating pipeline initiatives for increasing the number of skilled workers—while setting the stage for a potential dramatic increase in U.S. nuclear capacity over the coming decades, especially as the nation closes in on another decade of opportunity.

New Nuclear Market Developments

As governments across the U.S. shore up support for new nuclear, electric utilities, and other nuclear industry stakeholders have taken note of the wave of governmental contributions from numerous states, Congress, and the President, which have positively impacted market moves.

Utility Resource Plans

Utilities across the country continued to advance plans for new nuclear generation throughout 2025, reflecting growing interest in SMRs and next-generation fuels.

In the Southwest, Arizona Public Service, Salt River Project, and Tucson Electric Power jointly announced early in the year that they are investigating the addition of new nuclear generation in the state, signaling growing interest in diversifying the region’s energy mix.

In the Great Plains, Nebraska is emerging as a prospective hub for SMR development. The Nebraska Public Power District spent much of the year evaluating 16 potential communities for a potential SMR site, culminating in December with the creation of the Great Plains New Nuclear Consortium. Joined by Omaha Public Power District, Lincoln Electric System, and the Grand River Dam Authority, the consortium aims to assess the feasibility of developing 1,000–2,000 MW of new nuclear capacity for deployment across the Southwest Power Pool region.

Midwestern utilities also ramped up their nuclear plans. Ameren signaled during the Missouri Nuclear Summit that nuclear power will play a larger role in its long-term planning. Ameren Missouri also received approval for a nuclear energy credit program in conjunction with a new large load tariff, allowing large non-residential customers with a demand of at least 100 MW to include nuclear energy attributes from utility-owned or sourced resources into their clean energy portfolio to support their sustainability and decarbonization goals. Moreover, AES Indiana announced a study of potential SMR sites at its Eagle Valley and Petersburg plants. TerraPower partnered with Evergy and the Kansas Department of Commerce to explore siting a Natrium reactor in Kansas, reflecting growing public-private collaboration in the state as well.

In the Northeast, Constellation announced plans to explore up to 2 GW of new advanced nuclear capacity at the Calvert Cliffs plant, effectively doubling the site’s current output. Meanwhile, the New York Power Authority advanced the state’s directive to develop at least 1 GW of advanced nuclear in Upstate New York, issuing requests for information to identify potential host communities and solicit actionable development concepts.

Image (above) of a potential GE SMR rendering for the Clinch River nuclear site. (Source: TVA)

The Tennessee Valley Authority (TVA) remained a national leader in utility-driven nuclear innovation. TVA submitted the first U.S. utility-led SMR construction permit application in May for a GE Hitachi BWRX-300 at the Clinch River site, with the NRC accepting the application for review in July. The federal utility also received $400 million in federal grant support from the DOE in early December to help speed up the deployment of, perhaps, the nation’s first Generation III+ SMR.

TVA also forged several groundbreaking partnerships: in collaboration with Kairos Power and Google, TVA signed the first-ever power purchase agreement (PPA) for electricity from a Generation IV reactor, delivering up to 50 MWe from the Hermes 2 plant, expected to be online by 2030. Agreements with ENTRA1 Energy and Type One Energy further positioned TVA to develop up to 6 GW of new nuclear capacity.

Nevertheless, many more utilities are still evaluating the economics of deploying SMRs and whether to stick with traditional large light-water reactors. Duke Energy in the Carolinas released its Carbon Plan and Integrated Resource Plan, detailing a preference to deploy SMRs while keeping its options open to a new AP1000. A leader in nuclear energy, the utility has positioned itself as a second mover in pursuing new nuclear projects and closed out the year by submitting its long-awaited early site permit application to the NRC for a potential nuclear reactor near a soon-to-be-retired coal plant in Stokes County, North Carolina. The application still allows the utility to choose from a variety of reactor designs for the site, including 600 MW of advanced nuclear capacity by 2037 and an SMR by 2036 if the technology offers the best value for customers in the Carolinas service territory.

Other notable milestones in 2025 included Southern Company, parent company of Georgia Power, and its irradiation testing at Vogtle Unit 2 in Waynesboro, Georgia, where the utility loaded 6% enriched uranium—the first U.S. plant to use next-generation fuel—demonstrating ongoing progress in advanced fuel application.

Notable Project Deployment

The U.S. nuclear market in 2025 demonstrated remarkable momentum, signaling strong prospects for the deployment and commercialization of both fission and fusion technologies within the next decade. Following the 2023 setback with the termination of the NuScale-Utah Associated Municipal Power Systems project, the market rebounded with a series of high-profile announcements and plant restarts in 2024 and now, 2025.

A historic milestone came in August when Holtec International successfully recommissioned the Palisades Power Plant in Michigan, marking the first time a decommissioned U.S. reactor has returned to operation status. The plant is expected to start delivering power early this year. This achievement followed NRC approval and the completion of key licensing steps, setting a precedent for future plant restarts. Holtec received $400 million in DOE grant funding to support the development of SMRs at the now-recommissioned plant site.

Map (above) of states with legislative, executive, regulatory, and electric investor-owned utility actions (IOUs) in 2025, with respect to new nuclear development. (Source: Justin Lindemann, NC Clean Energy Technology Center)

Advanced reactors gained significant traction nationwide. The Idaho National Laboratory will host Aalo Atomics’ first plant, Aalo-X, with an accelerated timeline targeting reactor criticality by July 4, 2026—the 250th anniversary of the adoption of the Declaration of Independence—using its extra-modular reactor (XMR) technology to help meet growing data center energy demands. Other notable projects with fast-moving plans last year included Sawtooth Energy’s 462-MW SMR project in Jerome County, Idaho, and Amazon, Energy Northwest, and X-energy’s plan for 12 XE-100 SMRs at the Cascade Advanced Energy Facility in Washington State. NuScale also secured NRC approval for its updated 77-MWe SMR design, enabling faster future deployments, while Dow and X-energy advanced licensing for an 80-MWe reactor at Dow’s Seadrift, Texas, chemical production site. Wisconsin explored the potential redeployment of the decommissioned Kewaunee Nuclear Plant for Terrestrial Energy’s integral molten salt reactor.

Fusion projects advanced rapidly alongside fission initiatives. Commonwealth Fusion Systems secured zoning approval in Virginia for its $2.5 billion commercial fusion plant, the first of its kind, while Helion broke ground on its Orion facility in Washington State, with energy supplied under a pioneering PPA with Microsoft by 2028. TVA partnered with Type One Energy to plan a 350-MWe Infinity Two fusion pilot plant that could repurpose retired fossil-fuel infrastructure, highlighting the intersection of legacy site reuse and advanced technology.

Investment in the nuclear fuel cycle and supply chain continued to grow. Centrus Energy announced plans to expand its Piketon, Ohio, enrichment facility to increase low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU) production to support fueling of advanced reactors. Licensing milestones also advanced: TerraPower’s Natrium reactor in Wyoming became the first commercial advanced reactor to receive an NRC environmental impact statement and completed its final safety evaluation by December, clearing the way for final licensing approval.

Interest in restarting legacy facilities gained renewed momentum. NextEra Energy and Google collaborated to restart the 615 MW Duane Arnold plant in Iowa, supported by a 25-year PPA and local regulatory approval. The DOE Loan Programs Office finalized a $1 billion loan to Constellation Energy for the recommissioning of Three Mile Island Unit 1, now the Crane Clean Energy Center, with operations potentially resuming as early as 2027.

Large-scale nuclear campuses also advanced. Fermi America secured a 10-year tax abatement and reinvestment zone for its 11 GW energy campus in Carson County, Texas, integrating nuclear, gas, and solar resources, with Westinghouse supporting licensing for four AP1000 units. Santee Cooper selected Brookfield Asset Management to complete the long-paused V.C. Summer Units 2 and 3, two partially constructed AP1000 reactors. Microreactor concepts also progressed, with NANO Nuclear and BaRupOn exploring deployment of KRONOS micro-modular reactors capable of providing 1 GW of capacity to the Liberty American Multi-Sourced Power hub in Texas.

Overall, 2025 marked an unprecedented year of activity and innovation in the U.S. nuclear sector, combining plant restarts, new SMR and fusion projects, fuel-cycle investments, and large-scale campus developments – a continuation of the swell of announcements made the year prior.

Image (above) of an illustrative rendering of Aalo Atomics Aolo-X extra-modular reactor (XMR). (Source: Aalo Atomics)

Looking Forward

All in all, 2025 has certainly been a pivotal year for advanced nuclear in the United States, building on prior progress and laying the groundwork for future large-scale deployment. While federal leadership over the last two administrations has advanced support for new nuclear on various fronts, from project demonstration funding to onshoring fuel supply chains, the current administration has taken a rigorous step forward by implementing sweeping executive orders and interagency initiatives to expand fission and fusion energy, streamlining regulation, and strengthening the workforce.

States and utilities have taken notice and responded with specific plans and partnerships. Across the Great Plains, Appalachia, the Midwest, and the Northeast, progress is being made toward deploying SMRs and other advanced nuclear projects. TVA has established itself as a national leader with a couple of first-of-a-kind agreements in both fusion and fission.

Additionally, as large load concerns have begun to peak due to the influx of new data centers amidst the global AI race, historic milestones and opportunities have emerged in response, such as the first-ever recommissioning of a nuclear power plant, and a domino effect of interest among other energy providers to do the same. To serve as a bridge until newer nuclear plants reach commercial operations.

Despite this progress, questions still remain about whether advanced nuclear can be fully commercialized soon and at what price. Success will depend on continued federal support, state investment, and private sector follow-through on initial plans, as well as the ability to navigate next-generation workforce and domestic fuel supply-chain challenges.

Still, looking ahead, 2025 may be remembered as the year the idea of advanced nuclear moved to a promising reality.

Contact us to learn about our DSIRE Insight subscriptions, custom research, and consulting offerings on nuclear energy policies and markets for interested individuals or organizations, including our biannual Nuclear Energy Policy Dataset.

Click here to read our 2024 round-up of noteworthy developments.