By: Rebekah de la Mora, Senior Policy Analyst

The past year was a big one for energy issues, from shifts in federal policy to dramatic increases in load forecasts, from EVs to the ITC to SMRs. Our team tracks four overarching categories on the regular – solar, grid modernization, electric vehicles, and power decarbonization. Along with those, we noted plenty of action in other topics across the year. Here’s what we saw as the top trends of 2025, in no particular order:

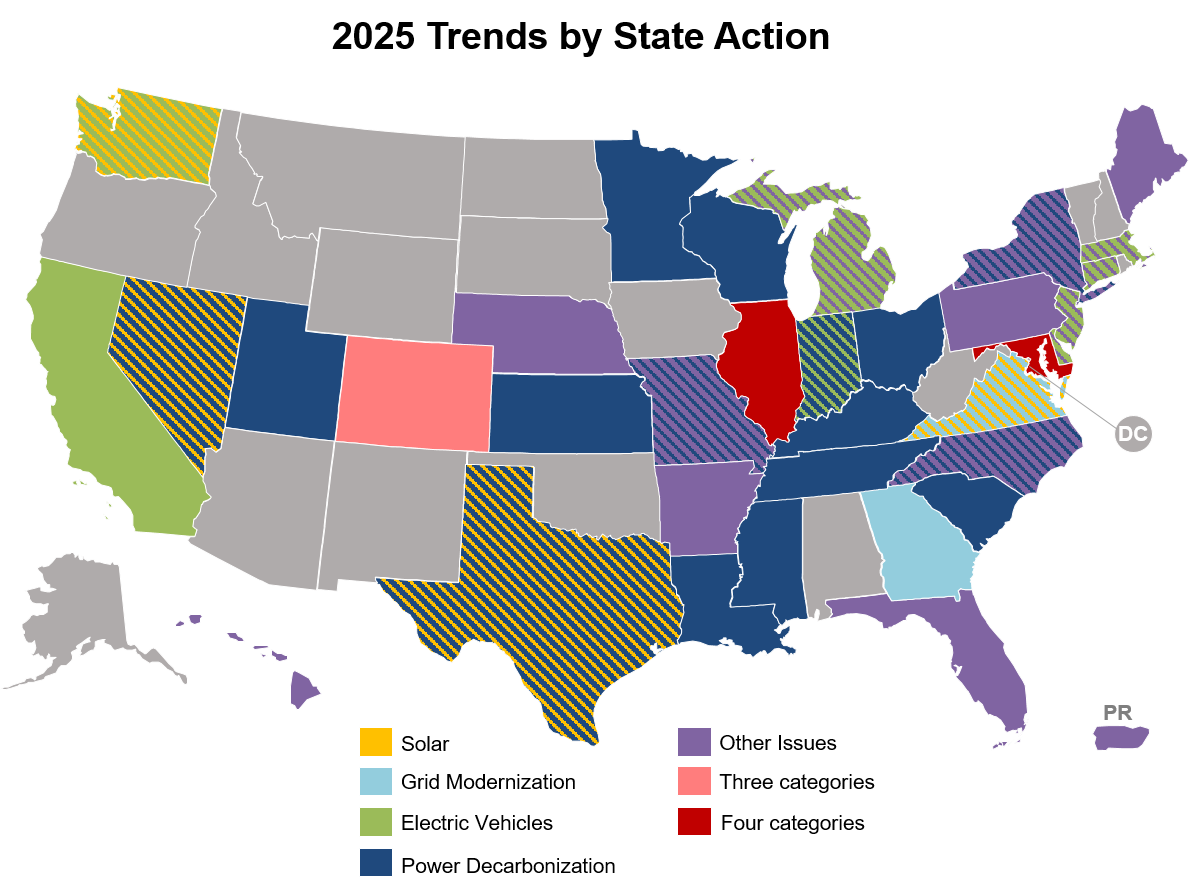

This map only demonstrates state actions specifically listed out in the blog post and is not meant to be comprehensive of every single action under these trends. Colorado falls under Grid Modernization, Electric Vehicles, and Other Issues. Illinois falls under Solar, Grid Modernization, Electric Vehicles, and Other Issues. Maryland falls under Grid Modernization, Electric Vehicles, Power Decarbonization, and Other Issues.

Solar

States and Utilities Transition to Successor Tariffs for Net Metering

Over the past twenty-five years, the distributed solar market has matured to the point where traditional compensation structures are being replaced by successor tariffs and program revisions that take the impact of distributed solar’s ever-increasing deployment into account. More states and utilities are transitioning to net billing or other types of successor compensation for distributed solar.

Ameren Illinois, Commonwealth Edison, and MidAmerican Energy finalized their transition at the beginning of the year, shifting to successor rates with one-hour netting intervals that were mandated back in 2021. Nevada regulators approved a new net billing program for Sierra Power utilizing a 15-minute interval, while it approved new mandatory demand charges for Nevada Power. Texas law now allows non-ERCOT utilities to propose “alternative methods” to compensate owners of distributed generation or qualified facilities; El Paso Electric proposed a new demand charge rate for residential distributed generation customers a few months before. Washington’s PacifiCorp proposed a new net billing program with a one-hour interval, as it has reached the statutory threshold for net metering. Dominion Energy Virginia also proposed a successor tariff, but with a 30-minute interval.

Grid Modernization

Utilities Pursue New Virtual Power Plants

With distributed generation becoming more widespread, utilities hope to take advantage of the new resource through virtual power plant (VPP) programs. VPPs allow utilities to take advantage of existing generation sources to serve their growing load. VPPs, either through a utility or third party, can remotely (“virtually”) manage multiple distributed generation sources simultaneously, allowing for coordinated dispatch to the grid and associated incentives for participants.

Commonwealth Edison proposed three VPP programs – for smart thermostats, energy storage, and community solar – but later withdrew the application in light of a bill that passed the Illinois General Assembly mandating two VPP programs with differing requirements; the utility plans to re-file in line with the bill. Xcel Energy Colorado proposed a new aggregator VPP program totaling 125 MW, and all four investor-owned utilities in Maryland filed VPP programs targeting energy storage and electric vehicles; both states passed bills in 2024 mandating the programs. Dominion Energy Virginia did the same, targeting demand response and demand-side management in response to a bill enacted earlier this year. Georgia Power included a VPP program within its 2025 Integrated Resource Plan targeting solar-plus-storage, which regulators approved.

Electric Vehicles

States and Utilities Implement Medium- and Heavy-Duty Electric Vehicle Programs

Electric vehicles deployment is expanding not just with light-duty vehicles, but also medium- and heavy-duty (MHD) vehicles. States and utilities are proposing new programs to serve these customers, as their size and usage differ enough from light-duty vehicles to require tariff and program innovation.

Connecticut regulators approved a new MHD program that includes specific tariffs for commercial MHD fleets, incentives for electric buses, and a fleet advisory program for school districts transitioning their school bus fleet. New Jersey investor-owned utilities filed MHD Plans, all of which included managed charging programs and make-ready incentives. Maryland regulators approved Baltimore Gas & Electric’s and Potomac Edison’s electric school bus pilots, helping school districts transition from diesel buses. DTE Electric in Michigan proposed a new DCFC rebate for school bus chargers. Many states are also including MHD charging infrastructure under subsequent phases of their National Electric Vehicle Infrastructure rollout, including California, Colorado, and Washington.

Regulators Instigate Vehicle-to-Grid Programming

As more drivers transition to electric vehicles (EV), states and utilities are looking for ways to utilize EVs to benefit the grid. Policymakers are particularly focused on vehicle-to-grid (V2G) capabilities, in which an EV is treated like an energy storage system that can discharge electricity onto the grid on demand.

Maryland regulators established rules for V2G connections, focusing on technical and administrative requirements for interconnection; Delaware is in the midst of doing the same. Connecticut regulators are considering a new Bidirectional Working Group to consider adding V2G to the state’s Energy Storage Solutions Program (functionally a virtual power plant). Regulators approved a new electric bus virtual power plant pilot for Ameren Illinois and a V2G pilot for Indiana Michigan Power. The Massachusetts Clean Energy Center launched a statewide V2G pilot for residential customers; cohort selection took place throughout 2025.

Power Decarbonization

States and Utilities Develop Tariffs Targeting Large Load Customers

At the forefront of rate design innovation this year was tariffs dedicated specifically to large load customers. Utilizing elements like minimum load requirements, ramp-up provisions, or clean energy requirements, among others, states and utilities are developing new rates tailored to the unique characteristics of large load customers like data centers.

Nevada Power established a new Clean Transition Tariff for large load customers, which is a green tariff these customers can enroll in; Indiana regulators ordered Indiana Michigan Power to develop a similar tariff. Three utilities in Missouri proposed tariffs targeting customers over 100 MW, including optional riders for clean energy, demand response, and wholesale market participation. AEP Ohio made a new customer class specifically for data centers, with a new associated tariff to serve them; Duke Energy Carolinas proposed revisions to its service regulations to address loads over 50 MW in South Carolina. Looking to the future, states like Minnesota, Texas, and Utah passed bills this year requiring utilities to develop large load tariffs.

Utilities Plan for Firm Energy Additions

As utilities plan for the future, many are looking towards firm energies like natural gas, energy storage, and nuclear to serve their expected load. For the first time since we started tracking utility capacity additions back in 2023, natural gas was the top addition nationwide in Q1 2025. Utilities are proposing new nuclear facilities, both traditional and advanced, and are also looking into novel types of energy storage.

Duke Energy Indiana, Kentucky Utilities, Evergy Missouri West, Duke Energy Progress in North Carolina, and Wisconsin Electric Power all have pending or approved natural gas facilities over 1,000 MW each, while Tennessee Valley Authority (TVA) released an RFP targeting over 1,200 MW. TVA also announced plans for a first-in-the-nation power purchase agreement for 50 MWe from an advanced nuclear plant, while utilities like Indiana Michigan Power and Ameren Missouri included over 1,000 MW each of nuclear energy in their 2025 Integrated Resource Plans. Utilities in Maryland are in the processes of planning to procure a collective 750 MW of energy storage to comply with statute, while utilities in New York had open RFPs targeting bulk energy storage projects, up to 10 MW per utility except for Consolidated Edison, which is targeting 300 MW.

Utilities Integrate Expected Load Growth into Future Planning

The electric grid is facing an ever-increasing demand for electricity from a wide range of sources including beneficial electrification, transitions to electric vehicles, requests from new large load customers, and even population shifts. In order to manage this exponential growth, utilities are integrating forecasts for high load growth into their grid planning.

Entergy Mississippi implemented maximum demand thresholds for some of its large customer tariffs so that it can ensure very large load additions are aligned with its resource planning needs and ensure proper cost allocation. Indiana lawmakers allowed utilities to file expedited generation resource plans to supply the needs of large load customers. Minnesota Power included multiple industrial load growth scenarios in its 2025 integrated resource plan (IRP), with one scenario expecting 1,100 MW of growth. Cleco Power considered upside-load growth in its interim 2025 IRP, noting that load forecasts may cause significant changes in the final version. Multiple utilities re-filed integrated resource plans because of dramatic changes in their load forecasts, including all four Evergy subsidiaries and Mississippi Power. On a broader scale, wholesale markets like PJM, MISO, and SPP are also planning for load growth, implementing new interconnection rules for large loads and associated generation to serve them.

Other Issues

States Show Support for Nuclear Energy

As load growth driven by electrification, new manufacturing, and AI data-center build out increases the need for additional generation, states and utilities increasingly view the expansion of nuclear energy as a strong option for firm power.

A range of states, from Arkansas to Hawaii, enacted legislation mandating or supporting nuclear feasibility studies, with a particular focus on advanced nuclear. Florida’s Public Service Commission released its final nuclear-feasibility report earlier this year. Maine policymakers revised the state’s renewable portfolio standard to include nuclear energy as an eligible clean energy resource. North Carolina and Missouri lawmakers authorized early cost recovery for utilities for base load energy infrastructure, such as nuclear projects. Connecticut softened its existing nuclear moratorium by adding an exception for projects supported by affected municipalities.

States and Utilities Address Energy Affordability

As electricity prices rise, states are looking for ways to lower the burden of energy costs on customers. From expanding affordability programs, to prioritizing low-income customers for incentives, there are various ways for states and utilities to improve energy affordability.

Ameren Illinois implemented a new low-income discount rider, and net metered participants will receive the discount after their net metering credits are applied to the bill. Last year, Connecticut regulators transitioned its low-income discount rider from two tiers to five; this year, regulators ordered utilities to shift customers to their new tier as soon as possible, instead of waiting for the administrative end-of-cycle. Xcel Energy Colorado proposed a new community solar program specifically for low-income customers, in line with 2024 legislation. Puerto Rico legislators are considering a 24-month moratorium on rate increases for PREPA; as of writing, the joint resolution has passed the first chamber. Delaware policymakers established the Delaware Energy Fund to provide bill assistance to low-income customers, while Delmarva Power & Light proposed a new low-income residential rate in its new rate case.

States Respond to Federal Policy Changes

The passage of H.R. 1, also known as the One Big Beautiful Bill Act, significantly limited the availability of federal tax credits for renewable energy resources. In response, many states amended existing incentive programs, altered interconnection rules, or established quick-turnaround procurements so that applicants could still take advantage of the federal incentives before they disappear.

The Governor of Puerto Rico signed an executive order authorizing extraordinary measures to evaluate and approve projects that qualify for the ITC; this resulted in a RFP with a forty-day turnaround. The Governor of Colorado also signed an executive order, ordering state agencies to streamline the review and approval process for facilities. Maryland regulators did something similar, launching a solicitation using an expedited permitting process. New York regulators proposed a streamlined interconnection process taking the tax credit deadlines into account; their New Jersey counterparts revised community solar rules to allow applicants losing their tax credits to re-apply in the next round. Connecticut regulators increased the bid price cap for its non-residential net metering and community solar programs, to compensate for the loss of the tax credits.

Lawmakers Reform Permitting and Siting Processes

As states continue to strive toward their energy storage targets, others without formal targets are also seeking to reform permitting processes for these projects to strengthen grid modernization efforts. These efforts can be found in legislative efforts across the nation.

The Governor of Hawaiʻi signed an executive order directing all state agencies to work with stakeholders to create an expedited permitting process, with an emphasis on distributed energy resources. In Massachusetts, legislators introduced two bills that would allow for accelerated permitting through an electronic process. Similarly, Michigan legislators introduced a bill requiring local governments to establish residential instant solar permitting platforms, including for systems paired with energy storage. Pennsylvania lawmakers introduced a measure to establish a Reliable Energy Siting and Electric Transition Board, aimed at creating a new permitting process for energy storage facilities and other reliable energy projects. Nebraska policymakers introduced a bill designating certain counties as “American energy friendly,” which would relax permitting regulations while strengthening taxes on any projects in those counties.

The examples listed here are non-exhaustive – want more information on these and other trends in energy policy? Check out our 50 States quarterly report series, and stay tuned for our annual reports coming out next month!