By: Emily Apadula, Policy Analyst

What is the first thing you think of when you see the word cryptocurrency? For some, it's the economic opportunity, for others, it’s flat out confusion. Maybe, like me, your mind goes straight to Dogecoin, the crypto-meme that swept through social media a few years back. Regardless of what does come to mind, chances are it’s not energy usage, but maybe it should be.

Cryptocurrency and Crypto Mining

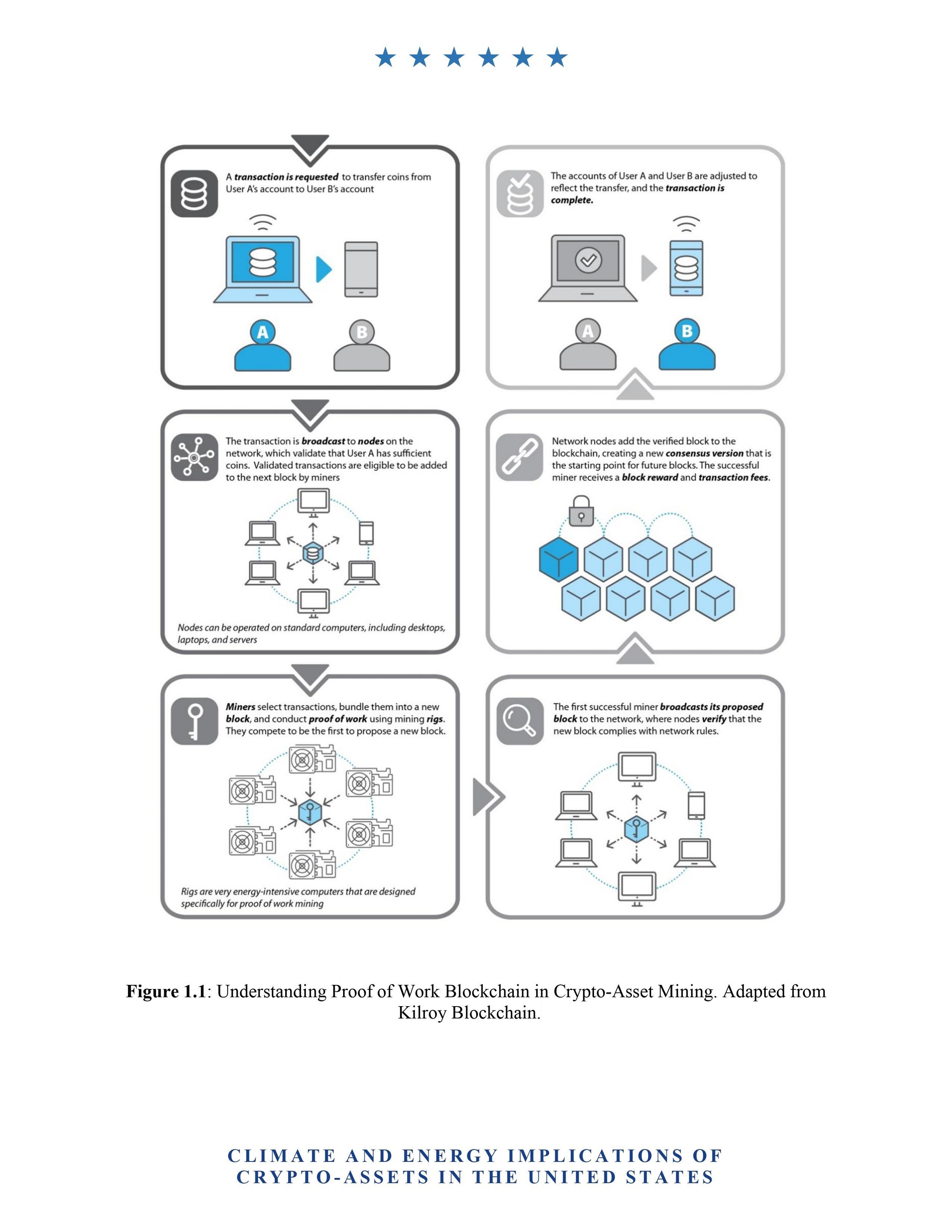

Cryptocurrency is a digital or virtual currency where transactions are verified and records are maintained by a decentralized network that is distributed across a large number of computers, also known as blockchain. A fundamental part of this system, mining, is the process by which transactions are validated and new cryptocurrency is entered into circulation. Miners compete to be the first to validate a series of transactions, a block, and add it to the blockchain. They are then rewarded with cryptocurrency for their efforts. When crypto first entered the market, individuals could win this competition with personal computers, however, as the value of crypto grew, mining became an industrial endeavor. Verifying transactions and recording them involves solving complex algorithms, meaning the more computing power you have, the better your odds are of winning. But more computing power means more energy consumption.

Source: OSTP (2022). Climate and Energy Implications of Crypto-Assets in the United States. White House Office of Science and Technology Policy. Washington, D.C. September 8, 2022.

The Energy Impact of Crypto Mining

As explained above, mining for crypto involves competing to be the first to solve an algorithm, verify transactions, and record them in the blockchain in exchange for cryptocurrency. The more people compete, the more complex the algorithm becomes, and the more computing power is required to solve the algorithm. This is where crypto miners come in with warehouses full of powerful and power-hungry computers.

Source: OSTP (2022). Climate and Energy Implications of Crypto-Assets in the United States. White House Office of Science and Technology Policy. Washington, D.C. September 8, 2022

A one-megawatt crypto mining facility consumes more energy daily than a typical U.S. home does in two years. Just ten of the mines located in the state of Texas use more than 1,800 megawatts of energy and the state shows no indication of slowing down. In March 2023, the state’s grid operator, ERCOT, approved plans to connect an additional 4,000 megawatts of mining operations this year and expects continued growth in the sector, estimating a total of 33 GW to be in use by 2026.

Source: DeRoche, M., Fisher, J., Thorpe, N., and Wachspress, M., The Energy Bomb: How Proof-of-Work Cryptocurrency Mining Worsens the Climate Crisis and Harms Communities Now (Sept. 2022).

As of August 2022, total global electricity usage for mining was between 120 and 240 billion kilowatt-hours per year, or 0.4% to 0.9% of annual global electricity consumption. This may seem like an insignificant amount, however, it exceeds the total annual electricity usage of many individual countries, including Argentina and Australia. In the U.S., where about a third of operations are located, mining accounts for 0.9% to 1.7% of total electricity consumption in the country. This is equivalent to the electricity it takes to power all home computers or residential lighting in the country.

Emissions

Most of the energy in this country is produced from fossil fuels, so it should be no surprise that consuming large amounts of electricity creates large amounts of pollution. In 2022, global mining operations were responsible for an estimated 110 - 170 million metric tons of carbon dioxide (Mt CO2), with emissions in the U.S. estimated to be 25 - 50 Mt CO2 per year. The emissions in the U.S. were three times that of the emissions from the largest coal plant in the country.

Many mining companies argue that they are not responsible for these emissions, claiming their operations release no pollutants. Some of the largest mining companies reiterated this in a letter to the Environmental Protection Agency (EPA) sent in May 2022. In this letter the companies state “miners have no emissions whatsoever,” instead asserting that associated emissions are the fault of electricity generation. Despite this, many companies promote themselves as environmentally friendly and locate their operations in areas rich with renewable energy. One such company, Riot Platforms, addressed this in a letter to Congress sent in 2022. The letter claims that mining is “uniquely beneficial and supportive of renewable energy.”

According to some experts, however, the operations’ demand for power is more likely to keep fossil fuel plants in business than lead to more renewable energy as the demand for power is far greater than what renewables can supply on their own. For example, Riot Platforms, the company quoted above, was found to have 96% of the power demanded it added to the grid met by fossil fuels. But they are not the only ones, this is a trend that is occurring across the country. In New York, a previously closed fossil fuel power plant reopened to power a mining center. A coal plant in Montana, slated for closure and operating just 46 days in 2020, was brought back to near full capacity the next year after Marathon Digital Holdings, a mining company, became the sole recipient of the produced electricity. In one quarter, the plant emitted 5,000% times more carbon dioxide than it had during the same time period the previous year. The trend continues in Pennsylvania, Kentucky, and Indiana.

In search of cleaner energy, some mining companies have turned their attention towards nuclear. Nuclear energy is considered to be a clean or carbon-free way of producing power, but not renewable as the resources used to produce nuclear energy are not naturally replenishing. TeraWulf, a mining firm in Pennsylvania, struck a deal to receive 100% of their energy from the Susquehanna nuclear plant. While utilizing nuclear energy is a way for crypto mines to decrease their emissions, it is not without its drawbacks. Nuclear plants not only create radioactive waste, but use large amounts of fresh water. A 2007 environmental impact assessment by the Nuclear Regulatory Commission estimated that the same plant, which now services TeraWulf, took in more than 58 million gallons of water per day, that's the equivalent of almost 90 Olympic swimming pools. That being said, all sources of energy have benefits and drawbacks, it's about balancing the positive and the negative.

However, in addition to emissions and increased water usage, crypto mines are responsible for thermal pollution, noise pollution, and large amounts of E-waste and it is often the surrounding communities who experience these impacts.

Pricing

When crypto comes to town, surrounding communities could also experience increased energy prices. For example, the increased electricity demand caused by several crypto mines located in Texas led to a price hike of nearly 5% or $1.8 billion per year, while in West Texas, the increase was closer to 9%. When crypto mines showed up in Plattsburgh, New York, electricity bills for local residents increased by 30%. Since the mines’ arrival, residents and small businesses have, respectively, paid an additional $189 million and $90 million for their electricity. However, when the New York Municipal Power Authority attempted to increase rates for the miners, many simply left the area.

The ease in which mines are able to be moved from one location to another along with their ability to be shut off almost immediately, provides the industry a great economic benefit. Several companies take advantage of their mobility to deploy mobile data centers to oil and gas extraction sites. The centers are powered by natural gas that would have otherwise been flared, a process by which natural gas is burned off in a controlled process when extracting oil. This process provides additional income for the extraction companies which, in theory, could lead to lower oil and gas prices.

Other mines take advantage of their ability to quickly power down to avoid paying fees during peak demand periods, an ability which most other industries, like hospitals and factories, do not have. However, according to the Blockchain Association, a pro-crypto NGO, the ability to quickly decrease demand can provide benefits beyond the mining companies. The association states that mines in Texas have helped stabilize grid prices by routinely increasing and decreasing their demand. This can occur when mines participate in demand response programs, in which customers are incentivized to reduce electricity usage during peak demand periods.

Meanwhile, mines in some states receive extra revenue from selling electricity back to the grid at a premium or being paid to shut off. Texas grid operators pay mining companies for agreeing to shut down operations if necessary to prevent blackouts. Mining operations are rarely asked to do this, and are only asked to shut down for a few hours most years. Through this program, five operations have collected at least $60 million since 2020. However, when mines are asked to shut down, they are paid even more. During Winter Storm Uri in 2021, one company was paid $175,000 every hour it stayed off the grid, resulting in the company earning more than $18 million over four days.

Programs like these allow mining companies to pay minimal amounts for their energy consumption and pass the costs on to other customers. In 2022, Riot Platforms in Texas paid 2.96 cents per kilowatt-hour, less than half of what other industrial businesses paid at 7.2 cents/kWh. And leaving residential customers to shoulder most of the burden, paying 13.5 cents/kWh.

The Great Mining Migration

Cryptocurrency has been publicly available since 2009, which may cause some to question the sudden interest over thirteen years later. Well, all of this activity has a single root cause, the great mining migration.

Since the beginning, miners have been chasing the presence of cheap energy to run their operations and for many years they found it in China. China not only has dozens of hydroelectric dams and wind farms, but an abundance of coal to produce electricity at relatively inexpensive rates. These rates were so beneficial that by 2019, three fourths of the world’s mining operations were located in China. This all changed in 2021. Two years ago, the Chinese government banned mining operations, citing their power usage among other reasons. This prompted the great mining migration.

With China no longer available, mining operations were on the hunt for a new area with cheap power, and they set their sights on the United States. Just a year after China’s ban, the U.S. became the leader in crypto mining, hosting 35% of operations, a dramatic increase from 4.1% in 2019.

Source: DeRoche, M., Fisher, J., Thorpe, N., and Wachspress, M., The Energy Bomb: How Proof-of-Work Cryptocurrency Mining Worsens the Climate Crisis and Harms Communities Now (Sept. 2022).

State Action

With the sudden influx of crypto mines, states have begun taking action. As of February of 2023, more than 60 bills, addressing some aspect of cryptocurrency, have been introduced in 25 states across the country. Some states are working to attract new mines, while others work to set regulations. Below are some of those bills that focus on the energy side of crypto.

Against:

In 2022, New York became the first state to take action against crypto mining when A.B. 7389C was signed into law. The bill creates a two-year moratorium on new mining operations that run on carbon-based power sources within the state.

In Washington, the majority of crypto mining operations are served by municipal and consumer-owned utilities, currently these operations are exempt from Washington’s Clean Energy Transformation Act (CETA). Introduced this year, H.B. 1416 would end that exemption by extending provisions of the CETA to customers of consumer-owned utilities. The bill has passed both the House and Senate and is currently awaiting approval by the Governor.

Similarly, Oregon’s H.B. 2816 seeks to eliminate a loophole commonly used by crypto miners by extending its emissions controls to high-load customers of consumer-owned utilities. Currently, the state’s emissions controls only apply to investor-owned utilities and not consumer-owned utilities that are often providers for crypto mining. The bill has yet to pass the House.

Texas S.B. 1751 would eliminate incentives previously put in place to attract miners to the state. The bill would prevent miners from participating in the state-run demand response program, which currently rewards miners for feeding power back to the grid when demand is high. The bill also eliminates the tax incentives and subsidies put in place for miners. It recently passed the Senate.

Pro:

Several states have taken similar measures to protect crypto mining. Bills introduced in four states protect mining operations from restrictive actions that could be imposed by local governments and prevent crypto companies from being singled out by laws and restrictions. These bills also prohibit electricity providers from charging “discriminatory rates” to mining operations.

Montana's “Right to Mine” bill (S.B. 178) and Arkansas’ “Data Centers Act of 2023” (H.B. 1799) have both passed the House and Senate and are currently awaiting approval by the Governor of their respective states. Missouri’s H.B. 764, “Digital Asset Mining Protection Act,” has yet to pass the House. And after passing the Senate, Mississippi’s S.B. 2603 died after failing to pass before the end of the legislative session.

Unlike the other states in this section, Oklahoma’s S.B. 443 creates an incentive to draw crypto mines to the state. The bill creates the “Orphaned Well Bitcoin Mining Partnership Program” which gives mining companies temporary control of the energy from the well in exchange for assuming the liability of plugging, remediating, or reclaiming an orphaned well. The bill has yet to pass the Senate.

Federal Action

While individual states have been working to promote or limit crypto mining with their jurisdiction, the federal government has not been silent on the issue. In March 2022, President Biden issued Executive Order 14067 on Ensuring the Responsible Development of Digital Assets. The order emphasizes that the responsible development of digital assets includes reducing pollution and negative climate impacts. It also instructed the White House Office of Science and Technology Policy (OSTP) to produce a report on the climate and energy implications of crypto mining in the U.S., the Climate and Energy Implications of Crypto-Assets in the United States was published in September 2022.

The report recognizes the benefits provided by crypto mining operations, however, it also cautions that these operations could hinder efforts to achieve the nation’s climate commitments and goals. The report goes into detail about mining operations’ impact on the grid and environmental impacts (discussed above).

This year, Congress introduced the “Crypto-Asset Environmental Transparency Act” with the companion bills S. 661 and H.R. 1460. The act would require mining companies consuming more than five megawatts of power to disclose their emission for operations. It also instructs the Environmental Protection Agency (EPA) to comprehensively investigate the impacts of crypto mining in the U.S.

However, not all in the federal government are fans of imposing regulations or restrictions on mining operations, as made evident at a March 2023 Senate hearing. The Air, Climate, and Environmental Impacts of Crypto-Asset Mining hearing consisted of a back-and-forth between legislators and advocates on both sides of the issue. However, H.Res. 238, introduced later that month, was decisively pro-mining. The House resolution was introduced for the purpose of expressing the importance of proof-of-work (POW) mining, the most used form of mining with high power demands, to the country’s ability to achieve its energy goals and grow the economy.

Looking Forward

The OSTP report makes several recommendations on moving forward with crypto mining in this country. These recommendations include setting energy efficiency standards, minimizing pollution and other impacts, encouraging transparency, and conducting further research. If minimization efforts prove ineffective, the report suggests, considerations should be given to potential limitations or bans of high energy intensity forms of mining.

Promising signs are also coming from the industry itself. Last year, Ethereum, the second-most-popular cryptocurrency, was able to reduce its energy consumption by 99%. The massive reduction in demand came from a change in algorithm, one that can be replicated by other crypto companies. Others in the industry have joined the Crypto Climate Accord, which aims to decarbonize the global crypto industry by 2040.

Crypto mines have migrated to the U.S., and chances are, they’re not going anywhere anytime soon. While some focus on the economic opportunities these companies could bring, the energy impacts of their operations are real and present an important issue for federal and state policymakers to consider.