By: DSIRE Insight and Smart Electric Power Alliance staff

U.S. states and electric utilities continue to explore – and increasingly prioritize – virtual power plants (VPPs) as a punctual, versatile solution to help meet challenges posed by rapid load growth. Indeed, a new industry report found that the North American VPP market has reached 37.5 gigawatts (GW) of flexible, behind-the-meter (BTM) capacity, a 14% increase over total VPP capacity in 2024, while the number of active VPP deployments, monetized programs, and unique offtakers each rose by more than 33% during the same time period.

Powered by legions of distributed energy resources (DERs), VPPs also boost grid flexibility, while offering utility customers opportunities to participate – and benefits for doing so. Scores of state-level regulatory activities, state-level legislative activities, and utility programs and proposals that will shape the future of VPPs and DER aggregation are currently unfolding. This blog builds on our Q2 2025 blog by highlighting key state- and utility-level developments in Q3, while also offering a sneak preview of what lies ahead.

Q3 2025 Updates

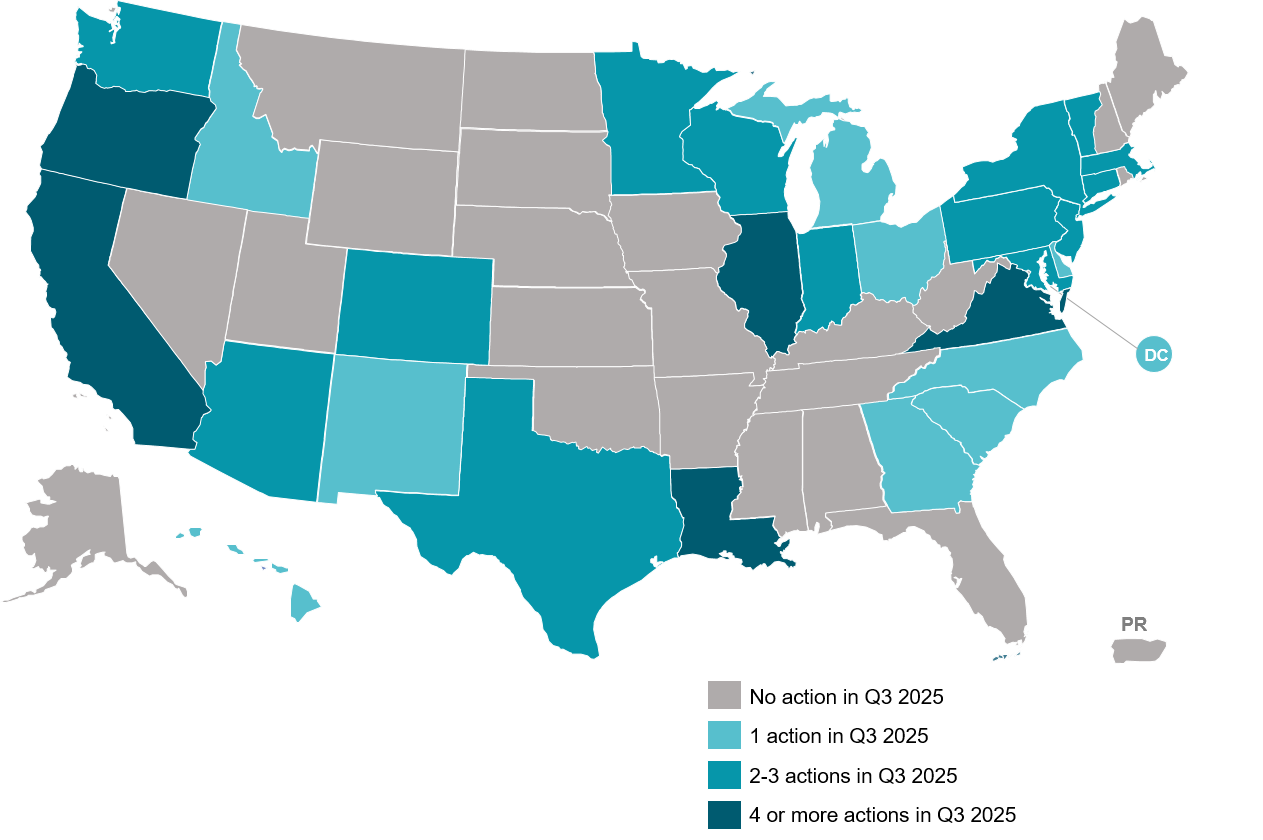

As VPP and VPP-supporting policy developments continue to arise and evolve around the United States, this quarterly snapshot summarizes the most meaningful activities addressing VPP design and deployment, compensation models, and industry and customer opportunities. The three maps below illustrate the breadth and prevalence of Q3 activities in U.S. states. Summaries of major Q3 regulatory and legislative developments are listed alphabetically by state further below.

Figure 1: State and Utility Actions Addressing VPPs and Supporting DERs, Q3 2025

Figure 2: Legislative and Regulatory Actions Addressing VPPs and Supporting DERs, Q3 2025

Figure 3: VPP and Supporting DER Actions by Type, Q3 2025

California

A.B. 1207 (VPP Program)

California’s Demand Side Grid Support (DSGS) Program – a large-scale VPP program – provided financial incentives to DER owners, operators, and aggregators to make their systems available for dispatch. The DSGS Program was funded by California’s Greenhouse Gas Reduction Fund, which itself is funded by the state’s Cap-and-Trade Program. A.B. 1207, enacted in September, replaced the Greenhouse Gas Reduction Fund with the California Climate Mitigation Fund for the purposes of providing direct rebates and investments to reduce household energy costs, including incentives to transition to zero-emission vehicles and energy-efficient housing – thus eliminating the funding source for the DSGS Program.

Colorado

Docket No. 25A-0061E (Xcel Energy – VPP Program)

Xcel Energy proposed a new Aggregator Virtual Power Plant (AVPP) program in January. The program offers DER aggregators performance-based compensation for capacity obligated to support system needs when requested by Xcel, with eligible DERs, including battery storage, smart thermostats, smart water heaters, smart heat pumps, and EV chargers. In August, within its Distribution System Plan docket (Docket No. 24A-0547E), Xcel filed a settlement agreement that would approve the AVPP program, with modifications. Under the settlement, which the Colorado Public Utilities Commission has not yet approved, methane-based, hydrogen-based, and front-of-the-meter DERs would not be eligible; participating DERs could not exceed 750 kW; total aggregations on a single feeder could not exceed 2 MW; and total aggregations on a single bank could not exceed 5 MW. While the program would utilize a standard-offer contract, 5 MW of the 125 MW of aggregate capacity must be procured through a competitive solicitation. Furthermore, Xcel would not participate as an aggregator for the first 24 months.

Connecticut

S.B. 4 (Demand Response Pilot, DER Aggregation)

Enacted in July, S.B. 4 aims to improve electricity affordability for ratepayers and to reduce structural inefficiencies in the electric transmission and distribution systems. To achieve these goals, state officials will, among other things, seek to (1) improve electric system utilization by improving the system load factor, (2) develop and implement policies and incentives to encourage the dispatch of energy generated by behind-the-meter (BTM) solar photovoltaic (PV) systems, and (3) study and report on methods to promote business growth in the state through electric load-growing energy policies. The Public Utilities Regulatory Authority may utilize existing programs to meet these goals, and/or expand an existing investigation into the state’s net metering and community solar programs to include the development of a framework to encourage DER aggregation that can provide grid and retail market services. S.B. 4 also requires the Department of Energy and Environmental Protection (DEEP) and PURA to create a demand response pilot, which may be coordinated with other states in ISO-NE. Under the pilot, utilities and third parties submit proposals to DEEP and PURA for review and approval. DEEP must complete an evaluation of the pilot by January 2028.

Georgia

Docket No. 56002 (Georgia Power – VPP Program)

In January 2025, Georgia Power filed its proposed 2025 integrated resource plan (IRP), covering the 20 years from 2025 to 2044. The proposed IRP includes a new 50-MW customer-side solar-plus-storage pilot program for residential and small commercial customers, with equal portions (25 MW) allocated for a customer-directed model (load curtailment with performance-based payments) and a utility-directed model (continuous operation of energy storage for an upfront incentive). Georgia Power also proposed deploying a DERMS, as well as a resilience program for large commercial and industrial (C&I) customers, which enables participants to retain ownership of DER systems while participating in demand response events. In July, the Georgia Public Service Commission approved a stipulation that includes the solar-plus-storage program, DERMS deployment, and the new C&I resilience program.

Hawaii

S.B. 589 (Grid Services Programs)

Enacted in July, S.B. 589 directs the Hawaii Public Utilities Commission to develop tariffs – with “fair compensation” – for grid services programs, microgrids, and community-based renewable energy. Tariffs must include a rider for energy storage systems and provisions that allow aggregators to participate in grid service programs. Energy exported to the grid by participating customers with PV systems paired with energy storage as part of a grid service program will be credited via a time-based rate that reflects resiliency, capacity, and ancillary service value.

Illinois

Docket No. 25-0678 (Commonwealth Edison – VPP Program)

In July, the Illinois Commerce Commission opened a docket to consider a series of three new tariffs ComEd has proposed: (1) Rider BYODLR – Bring Your Own Device Load Reduction Program, (2) Rider VPP – Virtual Power Plant Program, and (3) Rider CSS – Community Solar Plus Storage Program. Rider BYODLR would provide an annual incentive to customers with approved devices (smart thermostats) to make them available for remote control by ComEd or an Approved Device Load Reduction Program Provider during load-reduction events. Rider VPP offers an annual incentive to customers with energy storage to commit to system injections either directly through ComEd or through an Aggregation Service Provider (ASP). Rider CSS is similar to Rider VPP, but it targets and provides an annual incentive for community solar projects with energy storage.

Maryland

Case No. 9761 (Multiple Utilities – VPP Programs)

In July, BGE, Potomac Edison, Delmarva, and Pepco each filed proposed VPP programs and updates to their TOU rate calculation methodologies. BGE’s proposed VPP pilot would target and enroll existing and new residential BTM DERs, with a focus on stationary energy storage and EVs with bidirectional capability. Customers would receive up to $100 per month for participating in the pilot, with solar-plus-storage installations receiving a higher incentive payment. Potomac Edison’s proposed pilot targets and provides incentives for existing and new residential bidirectional-capable EVs and battery storage. Delmarva’s and Pepco’s jointly proposed pilot program targets and provides incentives for EVs with bidirectional charging capability and stationary battery storage devices.

North Carolina

Docket No. E-2 Sub 931, Docket No. E-7 Sub 1032 (Duke Energy – Demand Response Program)

In September, Duke Energy Carolinas and Duke Energy Progress proposed a new Non-Residential Storage Demand Response Program, as required by a November 2024 North Carolina Utilities Commission order that approved the two utilities’ residential PowerPair solar-plus-storage incentive program. Similar to PowerPair, the new program will provide incentives to non-residential customers who dispatch their storage systems during called demand response events, with participants agreeing to a minimum dispatch amount within their contract. Participants will receive a monthly capacity credit (adjusted by a capability factor) and an energy credit for each kWh dispatched.

South Carolina

Docket No. 2024-303-E (Duke Energy – DSM Programs)

In November 2024, Duke Energy proposed to revise its energy efficiency and demand-side management (DSM) programs for residential and non-residential customers. Its existing Equipment Control Rider provides incentives to residential customers who allow Duke to remotely control their HVAC systems, smart thermostats, and battery storage systems. Duke’s proposed revisions included raising existing incentive levels, adding a new upfront incentive for new participants in the HVAC program, and creating an incentive for water heater controls. Duke Energy also proposed revising its existing EnergyWise for Business Program, which targets demand response, by raising incentive levels and adjusting the months included within the different seasonal participation periods. In July, the South Carolina Public Service Commission approved a stipulation supporting Duke Energy’s proposed revisions to its programs.

Virginia

Stakeholder Process (Dominion Energy – VPP Program)

In September, Dominion Energy initiated a stakeholder process to develop a VPP pilot program, pursuant to legislation (H.B. 2346) enacted earlier in 2025, and invited written feedback (due October 6) from stakeholders. Dominion will propose a pilot program to evaluate demand-optimization methods, including VPPs, to the State Corporation Commission by December 1. The pilot must consist of DER aggregations totaling up to 450 MW, sited in multiple geographic regions.

Virginia

Docket No. PUR-00222 (Dominion Energy – Battery Storage Pilot Program)

In December 2024, Dominion Energy Virginia submitted its 2024 DSM Update for review and approval by the Virginia State Corporation Commission. The Update included three proposed new programs: a Non-Residential Distributed Generation Program, a Non-Residential Curtailment Program, and a Residential Battery Storage Pilot Program. In August, the SCC approved Dominion’s proposed Non-Residential Distributed Generation Program and Non-Residential Curtailment Program. However, because a 2025 law (H.B. 2346) requires Dominion to propose a pilot program (see above) to evaluate demand-optimization methods, including VPPs, by December 1, the SCC rejected the proposed Residential Battery Storage Pilot Program and instead referred it to a stakeholder process. When the stakeholder process concludes, Dominion must file a report alongside its proposed VPP pilot that describes the results of the stakeholder process.

Looking Ahead

We are expecting several major policy developments in Q4 2025. Keep an eye out for the following regulatory proposals and decisions:

Colorado: The Colorado Public Utilities Commission likely will rule on the pending settlement agreement addressing Xcel Energy’s proposed 125-MW AVPP program.

Minnesota: By October 3, Xcel Energy must propose a Distributed Capacity Procurement (DCP) program. Xcel’s filing must include an evaluation comparing the costs and benefits of a utility-owned and managed DCP model to models allowing participation from DERs owned by customers and third parties. (Hint: Xcel filed its proposed DCP program – deemed Capacity*Connect – on October 3, in Docket No. 25-378.)

Virginia: By December 1, Dominion Energy will propose a pilot program to evaluate demand-optimization methods, including VPPs. Dominion’s pilot must consist of DER aggregations totaling up to 450 MW, sited in multiple geographic regions.

Contacts

N.C. Clean Energy Technology Center (NCCETC) and SEPA collaborated to develop this summary of state policy developments addressing VPPs and VPP-supporting DERs in Q3 2025.

Rusty Haynes, SEPA, rhaynes@sepapower.org

Autumn Proudlove, NCCETC, afproudl@ncsu.edu

Additional Resources

DSIRE (Database of State Incentives for Renewables & Efficiency)

DSIRE Insight Policy Tracking

SEPA Customer Programs Working Group (meets monthly, virtually)

SEPA Distribution System Working Group (launches January 2026)

RE+ Midwest and RE+ Community Energy (Chicago, IL; December 2-4)

RE+ Hawaii (Honolulu, HI; January 27-28, 2026)

RE+ Northeast (Boston, MA; February 3-5, 2026)