By: Justin Lindemann, Policy Analyst

In 2023, significant advancements were made towards the deployment of advanced nuclear, from new federal and state legislation and regulatory actions, to updated utility resource plans and new market developments. During the year, 37 states had actions (i.e. legislative, executive, regulatory, and electric investor-owned utility actions) related to advanced nuclear.

State Legislative and Regulatory Developments

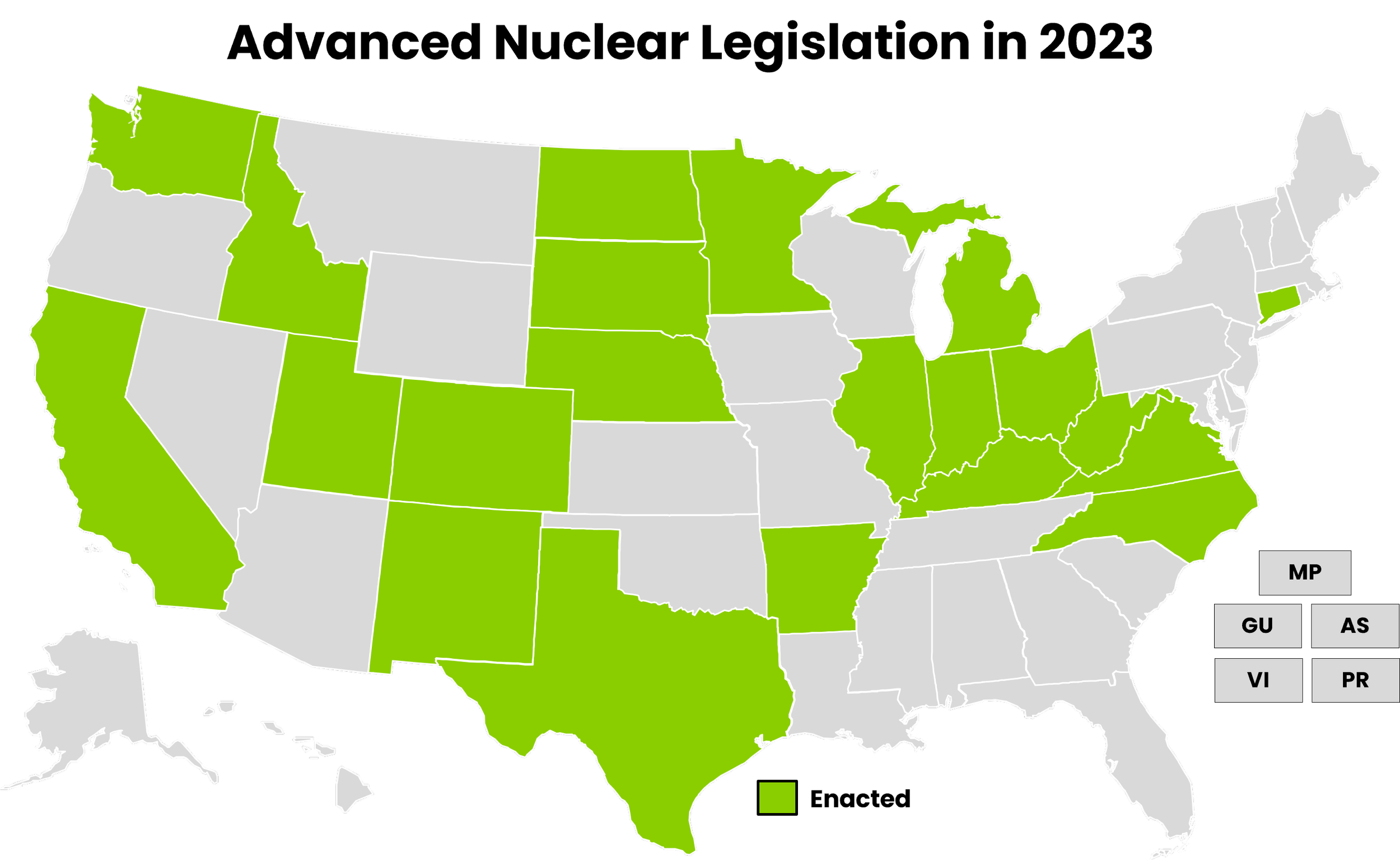

Stateside, at least 109 bills/resolutions were introduced in state legislatures across the country and 28 were enacted, while at least 2 other bills/resolutions passed at least one legislative chamber.

Notable 2023 state legislative and regulatory actions include:

New Jersey E.O. No. 315 – Signed in February 2023, New Jersey’s Governor enacted a goal to reach 100% clean electricity sales by 2035, which includes nuclear.

Virginia H.B. 2386 & S.B. 1464 – Enacted in March 2023, the bills establish a Virginia Power Innovation Program, for the purpose of establishing a state nuclear innovation hub from the innovation fund proceeds and awarding grants from the proceeds as well; and create the Virginia Power Innovation Fund to be used for the research and development of innovative energy technologies, including nuclear.

Indiana S.B. 176 – Enacted in April 2023, the state’s Public Utilities Commission must adopt rules concerning granting certificates for the construction, purchase, and leasing of SMRs (defined as having a capacity of max 470 MW).

Tennessee E.O. No. 101 – Signed in May 2023, Tennessee’s Governor established the Tennessee Nuclear Energy Advisory Council to help the state develop next-generation nuclear energy. The Advisory Council is responsible for delivering a preliminary report on opportunities for emerging technologies, funding opportunities, and various barriers related to nuclear expansion in the state; and a final report must be submitted by October 31, 2024.

Ohio H.B. 33 – Signed in July 2023, the bill creates the Ohio Nuclear Development Authority to support the state's mission in becoming a leader in the development and construction of advanced nuclear research reactors, commercial production, and high-level-nuclear-wastes reduction and storage technology research/development.

North Carolina S.B. 678 – Enacted in October 2023, after the state legislature overrode the Governor’s veto, the bill redefines the state’s Renewable Energy and Energy Efficiency Portfolio Standard to the Clean Energy and Energy Efficiency Portfolio Standard (CEPS) and now includes nuclear fission and fusion. Eligible resources under the amended state standard now include nuclear plants, a nuclear plant uprate, and fusion energy facilities.

Illinois H.B. 2473 – Enacted in December 2023, specifies that SMRs with a capacity of max 300 MW can be constructed starting January 1, 2026 – circumventing the state’s nuclear construction ban. A study by the Illinois Emergency Management Agency and Office of Homeland Security (IEMA-OHS) may be commissioned by the Governor on the potential of SMR development in the state, which must examine current SMR technologies and their corresponding safety risks, as well as federal/state/local regulatory and permitting issues. SMRs must also pay an annual low-level radioactive waste fee.

Several states enacted bills initiating studies related to the development or potential to integrate advanced nuclear technologies (SMRs, fusion, etc.), including California, Colorado, Kentucky, Nebraska, North Dakota, Ohio, Tennessee, and Washington. State regulators in Arizona, Louisiana, Michigan, and Texas initiated studies as well.

Federal Legislative Progress

Federally, the House passed a bill in December 2023 to prohibit Russian uranium imports, with the bill now situated in the Senate. Congress has introduced dozens of advanced nuclear bills related to spent fuel, domestic fuel supply, market development, and international cooperation, among other topics.

Several of the federal bills introduced are related to the build-out of a High-Assay Low-Enriched Uranium (HALEU) domestic supply chain. HALEU is a type of uranium fuel that is enriched between 5-20%, more than the usual nuclear fuel used today. The fuel type is included in numerous advanced reactor designs and currently only has a commercial supply chain in Russia. The Inflation Reduction Act allocated $700 million in funding to the U.S. Department of Energy (DOE) for the development of a domestic HALEU supply chain, with additional bipartisan support to further integrate production of the advanced fuel into the U.S. market.

Concerning the federal government’s intent to bolster the nation’s own competing HALEU supply chain, President Biden also signed the National Defense Authorization Act (NDAA) for fiscal year 2024 (H.R. 2067), which includes the following provisions to support this development. The NDAA FY24 enacts the Nuclear Fuel Security Act of 2023, which creates the Nuclear Fuel Security Program to increase the domestic quantity of LEU and HALEU produced by U.S. nuclear energy companies; expands the American Assured Fuel Supply Program to make sure there is available and domestically produced, converted, enriched, reconverted, and reduced uranium during supply disruptive events; creates the HALEU for Advanced Nuclear Reactor Demonstration Projects Program to maximize the DOE's potential to meet the needs of advanced nuclear reactor developers until a domestic HALEU supply is present and to partner with allies/partners to meet such needs as well.

Under the Nuclear Fuel Security Program, the Secretary of Energy must enter at least two contracts for both low-enriched uranium (at least 100 metric tons annually) and HALEU (at least 20 metric tons annually) acquisition by December 31, 2026, and December 31, 2027, respectively. Meanwhile, the expanded American Assured Fuel Supply Program must ensure a domestic supply of HALEU of not less than 3 metric tons by September 30, 2024; not less than an additional 8 metric tons by December 31, 2025; and not less than an additional 10 metric tons by June 30, 2026.

With this being the House version of the NDAA FY24 that was signed into law, the Senate version of the NDAA (S. 2226) – which did not advance to the President’s desk -- would have enacted additional advanced nuclear incentives and support for nuclear power plants sited on brownfields. S. 2226 included an incentive award program that certain first-of-its-kind and licensed advanced nuclear facilities (excluding fusion facilities) could have participated in, with the award being equal to the total amount assessed by the Nuclear Regulatory Commission (NRC) related to costs from license issuance and construction permit issuance, or from an early site permit.

The Senate version also would have directed the NRC to create a grant program to support the economic development of nuclear closure communities, which are those not collocated with an operating plant, are located near a site with spent fuel, have ceased operations or will cease operations of a plant. The NRC would have also been directed to evaluate any modifications to current regulations that could support the establishment of nuclear facilities at brownfield sites and implement strategies to enable timely licensing reviews for nuclear fuel production facilities or fuel utilization facilities (ex. reactors) at brownfield sites, including retired fossil fuel sites. While these provisions from the Senate version did not pass this time around, there is still a chance for them to be included in future fiscal year iterations of the NDAA.

Advanced Nuclear Market Growth

Additionally, a plethora of investor-owned utilities included advanced nuclear, specifically the latest and upcoming Generation IV infrastructure, as part of their resource plans or are considering such technologies as a potential future resource, including Rocky Mountain Power, Pacific Power, Georgia Power, Duke Energy (NC and SC), and Dominion Energy (VA and NC). Reviewing current utility resource plans, preliminary resource additions total to at least an estimated 5.5 GW of advanced nuclear by 2048 – a number that is expected to increase as more utilities consider advanced nuclear as a workable clean energy alternative. The Carolinas are currently leading the potential investments in advanced nuclear deployment, with Duke Energy already having one of the largest civilian nuclear fleets in the country, not to mention the world.

As for other utility-related actions, Georgia Power Company’s Vogtle Unit 3 began operations this year, with Unit 4 to begin in early 2024 (unless delays persist). Georgia’s Public Service Commission Staff recommended for approval Georgia Power’s proposed stipulation to recover $7.56 billion in capital and construction costs from the next-generation, Generation III+ reactors through significant rate increases. The increase adds an estimated $9/month to residential utility bills and was ordered approved by the Commission in late January 2024. The company also filed an update to its 2022 integrated resource plan, adding advanced nuclear as a cost-effective technology.

In terms of demonstrable advanced nuclear projects, the market has had its fair share of peaks and valleys during 2023, with substantial setbacks and major announcements having been made, including the following:

Dow and X-energy signed a joint development agreement, promising to develop four-units of X-energy’s Xe-100 high-temperature gas-cooled reactor for a total of 320 MWe. X-energy’s Xe-100 reactor is one of two awardees under the U.S. Department of Energy’s Advanced Reactor Demonstration Projects (ARDP), and will utilize the high temperature heat and electricity generated by the units to help decarbonize Dow’s UCC Seadrift Operations in Seadrift, Texas. The project is expected to start construction in 2026. Dow and X-energy will also develop and license technology that may be used by other industrial companies. (Press Release - 3/1/2023)

TerraPower announced that it purchased land in Kemmerer, Wyoming, the site of its Natrium reactor demonstration project. The Natrium reactor project is an awardee under the U.S. Department of Energy’s Advanced Reactor Demonstration Projects (ARDP), and is a 345 MW sodium-cooled fast reactor, replacing the site’s soon to be retired coal plant. The reactor will utilize a molten-salt energy storage system, which has the potential to increase the reactor’s capacity to 500 MW of power; and is expected to start construction this year. The planned but not-yet licensed sodium-cooled fast reactor utilizes HALEU as its fuel source. (Press Release - 8/16/2023)

BWX Advanced Technologies LLC (BWXT) announced a two-phase, two-year contract with the Wyoming Energy Authority to study the viability of small-scale nuclear reactor deployment. Phase one of the contract involves furthering the design of the BWXT Advanced Nuclear Reactor (BANR), a 50 MWt high-temperature and gas-cooled microreactor that uses a form of tri-structural isotropic (TRISO) fuel, so that it can be integrated into the state’s power needs. Phase two would include additional design improvements and a demonstration of the state’s manufacturing industry to substantiate a potential supply chain. (Press Release – 9/12/2023)

The Carbon Free Power Project, a six SMR unit project (462 MW) between the Utah Associated Municipal Power Systems and NuScale was terminated in early November 2023. The project would have launched in 2030, but due to the failure to reach the necessary subscription threshold – among other issues -- the project failed to continue with deployment. (Press Release - 11/8/2023)

Holtec International announced plans to site two of its SMR-300 units at the state's existing Palisades nuclear site. The company stated that the reactors would be commissioned by mid-2030 (according to their timeline), coming after the planned reopening of the 800 MW Palisades reactor in 2025 that is also pending approval. (Press Release - 12/4/2023)

Kairos Power was awarded a construction permit for its Hermes test reactor. The planned reactor is a 35 MW thermal test reactor in Oak Ridge, Tennessee, which uses a combination of TRISO fuel particles and a molten fluoride salt coolant (AKA Flibe). Construction is expected to be completed by 2027, and the plant will operate for four years. (Press Release - 12/12/2023)

Since the NRC declined their application for a combined license in early 2022, the 1.5 MWe (4 MWth) microreactor start up, Oklo, has made several major announcements in 2023 amidst relaunched efforts to achieve licensing for the Aurora powerhouse.

Oklo and Centrus Energy Corp entered a Memorandum of Understanding (MOU) to support the deployment of Oklo’s microreactors in Southern Ohio. Cooperation between Oklo and Centrus will support the development of a HALEU fuel facility in the region as well. Oklo’s reactor design utilizes HALEU, and the fuel facility will help support not just their microreactors but other designs needing to use the enriched fuel. (Press Release - 8/28/2023)

The company entered another MOU with Siemens Energy, designating Siemens as a potential preferred supplier for rotating equipment of the power conversion system associated with the Aurora powerhouse. The agreement moves the start-up one step closer to deploying the 1.5 MWe microreactor. (Press Release – 12/19/2023)

Nuclear-Hydrogen Nexus

Another emerging technology that gained headlines and monumental support in 2023 was hydrogen. The potential fossil fuel alternative has an expansive utility, and much like advanced nuclear, is still nascent with the hope of reaching commercialization across the globe. Both technologies crosscut paths in their efforts to decarbonize multiple sectors from industry to power, with advanced nuclear and existing nuclear technologies having the opportunity to power hydrogen production facilities through a variety of processes. From high-temperature steam electrolysis (using heat and electricity from nuclear plants to power an electrolyzer and produce hydrogen) to high-temperature thermochemical production (using high-temperature heat to split water molecules and create hydrogen), nuclear energy technologies have the capability to produce the sought-hydrogen supply needed by tomorrow’s industrial processes and load growth. Moreover, advanced nuclear technology types like high temperature-gas cooled reactors and gas-cooled fast reactors, have the potential to be a significant part of the hydrogen production fleet, as these technologies mature and commercialize.

In order to jumpstart the domestic hydrogen industry, the Biden-Harris administration finally released guidance in late December 2023 for the clean hydrogen production tax credit (45V), which would grant eligible hydrogen production facilities up to $3/kg of hydrogen. The guidance touches on three pillars of hydrogen production: incrementality, deliverability, and temporal matching.

Incrementality refers to guidance rules specifying that electricity generation facilities associated with a hydrogen production facility must have a commercially operational date (COD) that is within three years before a hydrogen production facility is placed into service. A hydrogen production facility must be placed into service by 2033 to receive the tax credit, which can only be collected for 10 years.

The guidance’s deliverability requirements require electricity produced for hydrogen production to be generated in the same region as the hydrogen production facility, to secure a steady stream of clean and reliable fuel. The guidance specifies that there are fewer intraregional or “within region” transmission constraints than there are interregional transmission constraints, with the chosen regions reflecting a better guarantee for electricity deliverability. The regions are based on the National Transmission Needs Study (found on pg. 3 of the study), and do not fully align with existing regional transmission organizations and independent system operators.

As for temporal matching, this describes, among other things, the requirement for electricity generation from eligible facilities to regularly (annually, monthly, hourly, etc.) match up with hydrogen production facilities and be verified as the production facilities’ fuel source. The guidance specifies that until the end of 2027, electricity generation must match up on an annual basis with the corresponding hydrogen production facility, as verified by energy attribute certificates (ex. RECs). Then, starting in 2028, matching will transition to an hourly basis. The strict matching rules make sure that low- to zero-emission electricity is what powers hydrogen production facilities, to verifiably meet the emissions requirements under the production tax credit. The rules also make sure that the tax credit does not incentivize emissions increases because of fossil fuel-based hydrogen production, which would then defeat the purpose of the CLEAN hydrogen production tax credit and weaken hydrogen’s promise as a clean choice, endangering the industry’s credibility as a result.

The guidance also touches on the potential use of existing nuclear facilities placed in service prior to 2023, as it relates to the incrementality requirements of the tax credit. Rather than having to be built within 3 years of a hydrogen production facility, the Treasury Department and IRS suggested a rule under which 5% of the hourly generation from an existing nuclear facility could be used for hydrogen production. Further comments are sought by the federal government to fully flesh out potential changes, including the possibility of implementing the 5% suggestion. The guidance stipulates that with potential retirements of existing nuclear power plants, including existing power plants in some capacity may reduce the risk of retirement for some plants, due to the economic benefits of the added hydrogen production tax credit and future hydrogen production.

The guidance states that nuclear power facilities eligible for the zero-emission nuclear power production tax credit (45U) may also be eligible for the 45V hydrogen tax credit if the electricity generated is used to produce clean hydrogen. However, existing plants eligible for 45U must be built before August 16, 2022, with none having been built or made commercially operable within the three-year period prior to that date; and since eligible electric generation facilities must be commercially operational within three years prior to a hydrogen production facility’s placed in service date in order to be eligible for the hydrogen production tax credit, mathematically this leaves out existing plants – unless the released guidance is amended. As for Vogtle Units 3 and 4, these advanced nuclear plants are not eligible for the 45U tax credit, but both are able to utilize the advanced nuclear production tax credit (45J); still, the guidance does not mention how and if the 45J credit may be paired with the 45V tax credit.

Public comments can be written or electronically submitted until February 24, 2024 (60 days after the official publication of the guidance) and a public hearing on these proposed regulations will be held on March 25, 2024. The Treasury Department and the IRS are seeking comments on the guidance and other related issues, including the extent to which the required matching, incrementality, and deliverability rules apply to existing nuclear generation, as already mentioned above.

Moreover, the Biden-Harris administration also released its $7 billion hub grant announcement towards the end of 2023, which included two awardees from the Midwest (MachH2) and Mid-Atlantic (MACH2) that are looking to utilize nuclear energy to generate hydrogen. However, the compatibility of the nuclear energy facilities used for the two hubs and the hydrogen production tax credit is still up in the air, due to existing facilities in the country not being eligible for the tax credit, because of the hydrogen production tax credits incrementality rules. As for new nuclear facilities, the incrementality rules will likely place such facilities out of eligibility due to electricity generation facilities needing to be first commercially operational within 3 years before an associated hydrogen production facility’s placed-in-service date (which must be before 2033).

All in all, from the noticeable state and federal support to the planned utility and market integration, 2023 proved to be one of the most momentous years for advanced nuclear technologies to date. Plus, with access to incentives and increased value because of potential hydrogen production, advanced nuclear technologies, and even the existing civilian nuclear fleet have been given a promising runway to develop and find success in the coming years. Yet still, whether advanced nuclear technologies can commercialize and take off is a question left unanswered.

For more information on nuclear and advanced nuclear, click here to check out our other blog post, titled “Nuclear’s Next Life”, about the history of nuclear in the U.S., existing advanced nuclear incentives and technologies, and continuing market progress.

Contact us to learn about our DSIRE Insight subscriptions, as well as custom research and consulting offerings on a variety of clean energy technologies for persons/organizations interested.