By: Rebekah de la Mora, Policy Analyst

With the start of the new year comes a review of the past year. No one missed the historic passing of the Inflation Reduction Act, which included almost $400 billion dedicated to energy and climate change action. The programs and incentives in the Act were varied and wide-reaching, but this wasn’t the only major policy development to come about last year. States took action on everything you could possibly think of, and probably a few things you can’t! As time goes on, more and more governments are trying to make their policies increasingly inclusive, particularly by implementing rules to benefit low-to-moderate income, or LMI, residents. We’ll be taking a look through state-level actions throughout 2022 – the big and the small – related to LMI rules across various categories.

Equity, Justice, and Affordability

Not all LMI action is tied to specific programs and incentives. Investigations into energy equity and environmental justice, while broad, will allow states to gather information to more effectively tailor their LMI benefits. In addition, standard electric rates with LMI provisions or bill assistance programs help improve energy affordability.

California’s Public Utilities Commission updated its Environmental and Social Justice Action Plan in April. The plan covers all of the state’s efforts to systemically incorporate environmental and social justice into the Commission’s work; in 2022, this led to a 65% LMI carve-out for a new transportation electrification rebate program and a 70% carve-out in the state’s Self-Generation Incentive Program.

Connecticut regulators established a Low Income Discount Rate and Low Income Discount Credit. The rate will provide customers with either 10% or 50% off their monthly electric bills, depending on which tier they qualify for. The credit is a temporary measure until the rate takes effect; both tiers will receive either $24 or $25 credits each month, depending on their utility. The credit began in January, while the rate is expected to go into effect in November.

Hawaii’s Public Utilities Commission opened a new proceeding in December to review integration of energy equity and justice into its proceedings as a whole. The proceeding will cover energy affordability, direct payment assistance, equitable access to clean energy, utility business model reforms, and procedural equity improvements.

Distributed Generation and Storage

Distributed generation, like rooftop solar and battery storage systems, are often out of reach to LMI customers due to financial constraints. By offering LMI-specific incentives, states and utilities can help bridge that economic gap.

California expanded its existing Self-Generation Incentive Program by $900 million; 70% of that money must be used in storage or solar + storage incentives for eligible LMI residential customers.

Colorado’s Xcel Energy received approval for updates to the Residential Income Qualified On-Site Solar program with 2 MW of capacity and $1.2 million in funding; this was originally the Colorado Energy Office Low-Income Rooftop Solar program.

New York approved its Distributed Solar Roadmap, with a goal of 10 GW of distributed solar by 2030. The roadmap expanded existing NY-SUN incentives by almost 3,400 MW, 1,600 of which is dedicated to LMI and related programs.

New York’s PSEG Long Island updated its Utility 2.0 Long Range Plan to include a new residential energy storage system incentive for storage systems paired with solar. LMI customers would receive larger incentives and would have a larger incentive cap; $400/kWh up to $10,000/project compared to $200/kWh up to $5,000/project for non-LMI customers. The incentive is expected to be available in Q3 2023.

Community Solar

As community solar programs are growing across the country, so are specific carve-outs or requirements to expand access for LMI customers. LMI carve-outs are being added to both new and existing community solar programs.

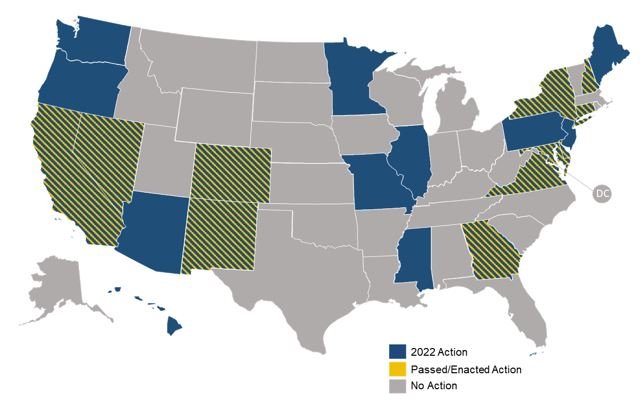

2022 LMI-Related Community Solar Activity

Arizona’s Corporation Commission opened a proceeding to establish a community solar policy last year. While a policy has not yet been established, at the end of the year the Commission ordered its Staff to propose a statewide policy including an LMI carve-out.

California A.B. 2316 authorized the state’s Public Utility Commission to establish a community solar program, which would require 51% of subscribers to be LMI customers or LMI service organizations.

Colorado’s Xcel Energy created a 20 MW program for income-qualified/disproportionately impacted communities in it Solar*Rewards Community program; these projects would be owned and operated by Xcel. In addition, 70% of the MW capacity in the standard RFP program must be dedicated to income-qualified/disproportionately impacted communities.

Connecticut increased its low-income customer carve-out from 10% to 20% of a facility’s capacity and its low-income customer, moderate-income customer, and low-income service organization carve-out from 10% to 60% of a facility’s capacity.

The Georgia Public Service Commission approved Georgia Power’s proposed income-qualified community solar pilot.

Maryland created a Resiliency Hubs Grant, which will provide funding to entities for community solar installations; in order to qualify, installations must ensure 30% of subscribers are LMI customers. The state also altered tax laws so that community solar installations are exempt from property taxes if at least 50% of subscribers are LMI customers.

NV Energy’s Expanded Solar Access Program received approval for two more projects. The program offers community solar access specifically to low-income customers.

New Hampshire’s S.B. 270 established an LMI program for qualifying community solar projects. LMI residential customers who have applied to the state’s Electric Assistance Program will be enrolled on an opt-out basis to receive subscriptions to designated community solar savings projects.

New York’s Public Service Commission approved National Grid’s and the New York State Energy Research and Development Authority’s Expanded-Solar For All Program (E-SFA) in January. The E-SFA Program will provide community solar and guaranteed bill savings to low-income customers. Customers enrolled in National Grid’s Energy Affordability Program (EAP) will be automatically enrolled; EAP benefits will not be affected by enrollment in E-SFA, and customers can be dual-enrolled in E-SFA and another community distributed generation (CDG) project. Phase 1 of the program will achieve $5 in monthly bill credits, while Phase 2 will achieve $10 in monthly bill credits.

New York began the process to create an opt-out CDG program, which would automatically enroll certain customers into a CDG facility and credit them using the state’s Value Stack. Assistance Program Participants (APP) customers would automatically be enrolled and would receive at least 10% in savings, compared to non-APP customers who would receive 5% in savings.

New York also began a review of its Inclusive Community Solar Adder, which is an incentive provided to community solar developers who dedicate at least 20% of their project’s subscription to LMI customers, affordable housing providers, and facilities serving disadvantaged communities. The state approved a Distributed Generation Roadmap in April, which increased Con Edison’s adder to $0.30/W for any leftover pre-Roadmap capacity; projects that meet additional Environmental Justice criteria would receive $0.40/W.

Texas’ El Paso Electric filed an application to establish a new low-income discount subscription for its community solar program. El Paso Electric’s program, while using the name “community solar,” is actually a green tariff program, and not a virtual net metering program. The current subscription rate is $17.64/kW for all customers; the application would lower the rate to $13.63/kW for LMI customers and $15.14/kW for all other customers.

Virginia regulators approved a minimum bill for Dominion Energy’s shared solar program, but LMI customers are exempt from paying it.

Electric Vehicles

Similar to distributed generation, EVs and at-home charging stations are often overly-expensive for LMI customers, but higher incentives can make them more affordable. Additionally, prioritization of underserved communities ensures public and state EV infrastructure is equitably distributed.

The Arizona Corporation Commission approved Tucson Electric Power’s and UNS Electric’s Transportation Electrification Plans. Both plans included higher LMI-specific incentives for residential and commercial charging station rebates.

Arizona Public Service proposed a new LMI rebate for charging stations under its managed charging pilot.

California established a $1 billion transportation electrification infrastructure rebate program. While the exact rebates have not been settled, at least 65% of the rebates must go to infrastructure in underserved communities.

Colorado established a rebate program for electric bikes, based off of Denver’s program. The rebate will provide LMI customers or bike shops serving LMI customers with purchasing rebates. Programs in disproportionately impacted communities or nonattainment areas will receive priority.

Colorado also established a grant for electric school bus charging infrastructure, under which disproportionately impacted communities or nonattainment areas will receive priority.

Connecticut established an accelerated adoption target of 100% of school buses in environmental justice districts must be zero-emission by 2030; 100% of all buses must be zero-emission by 2035. The Department of Energy and Environmental Protection will run a matching grant program to provide financial assistance to school districts.

Connecticut also expanded its existing CHEAPR EV Rebate program. Rebates for battery, plug-in hybrid, and fuel cell EVs were altered, and rebates for electric bikes were added. Priority will be given to residents of environmental justice communities, residents 300% below the poverty level, and residents who participate in state and federal assistance programs. Residents of environmental justice communities will receive larger rebates.

Michigan approved a new income-eligible rebate for DTE Energy’s Charging Forward Program. Lower-income customers will receive $5,000 rebates for EVs costing less than $50,000.

The New York State Energy Research and Development Authority announced $8 million for Round 3 of its DCFC Program. Round 3 focuses on areas that lack access to EV fast charging, including underserved communities, in Buffalo, Rochester, and Syracuse; at least 50% of sites must be in designated disadvantaged communities.